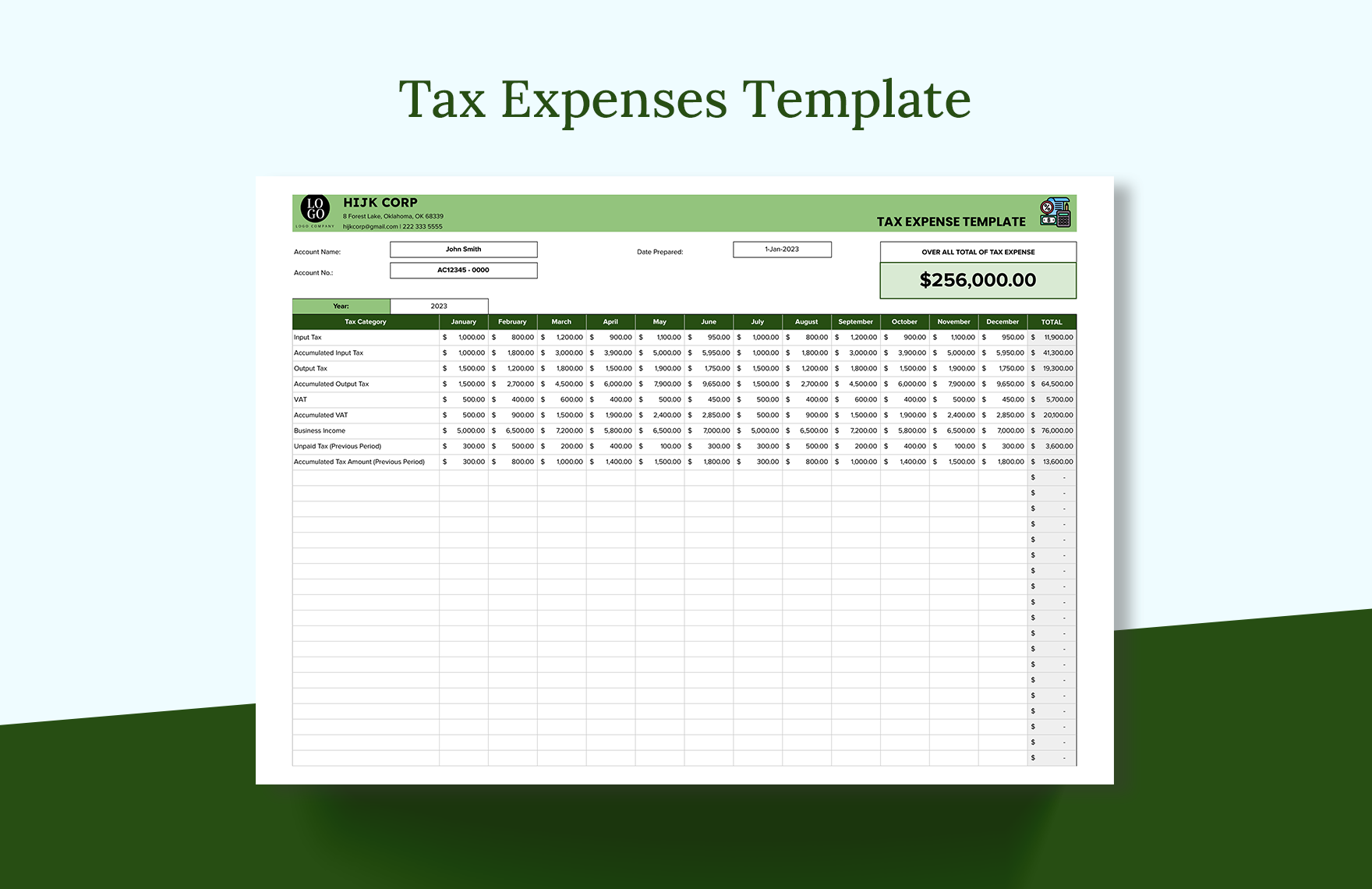

One Of The Best Info About Tax Expenses Template

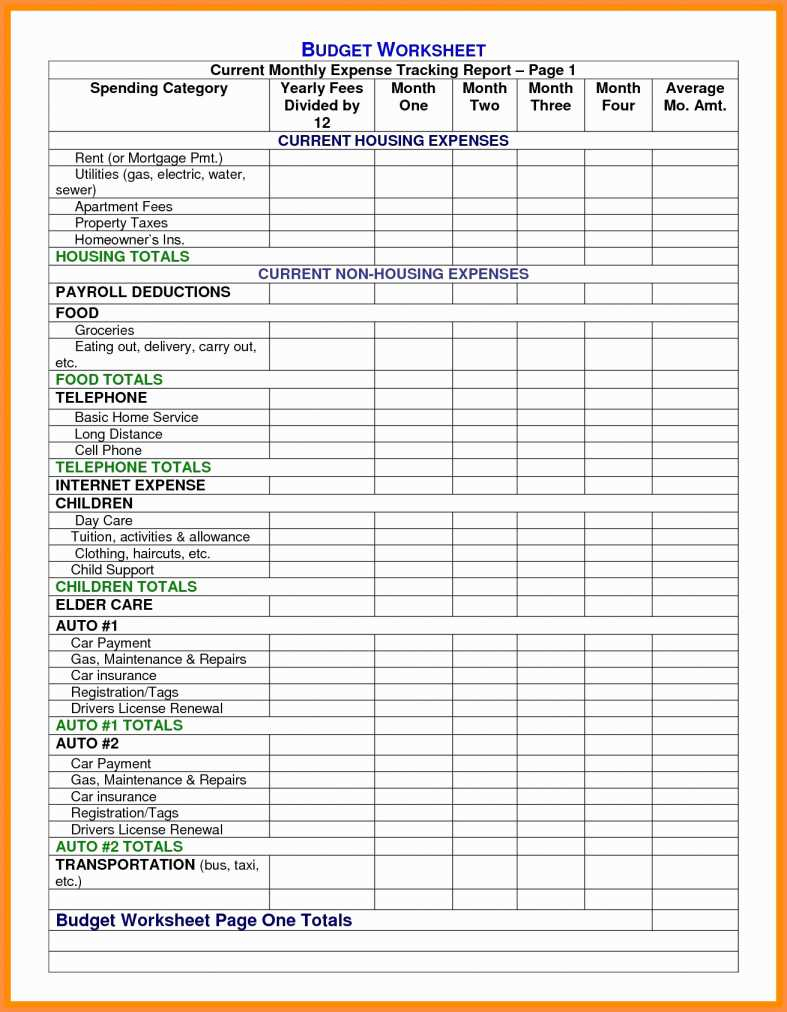

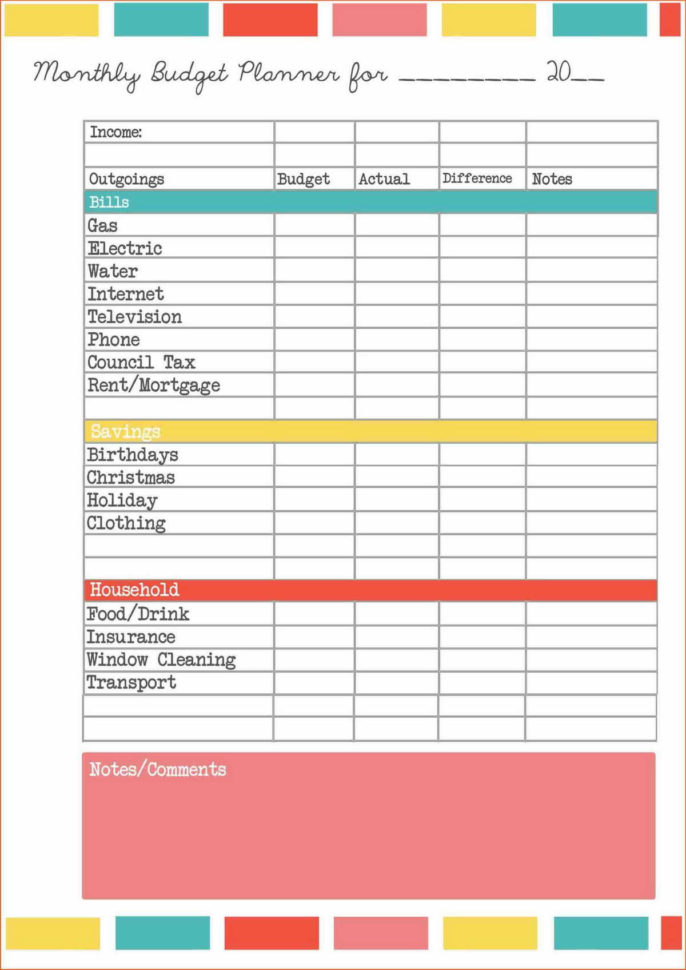

From tax calculators to expenses spreadsheet templates to top tips and more!

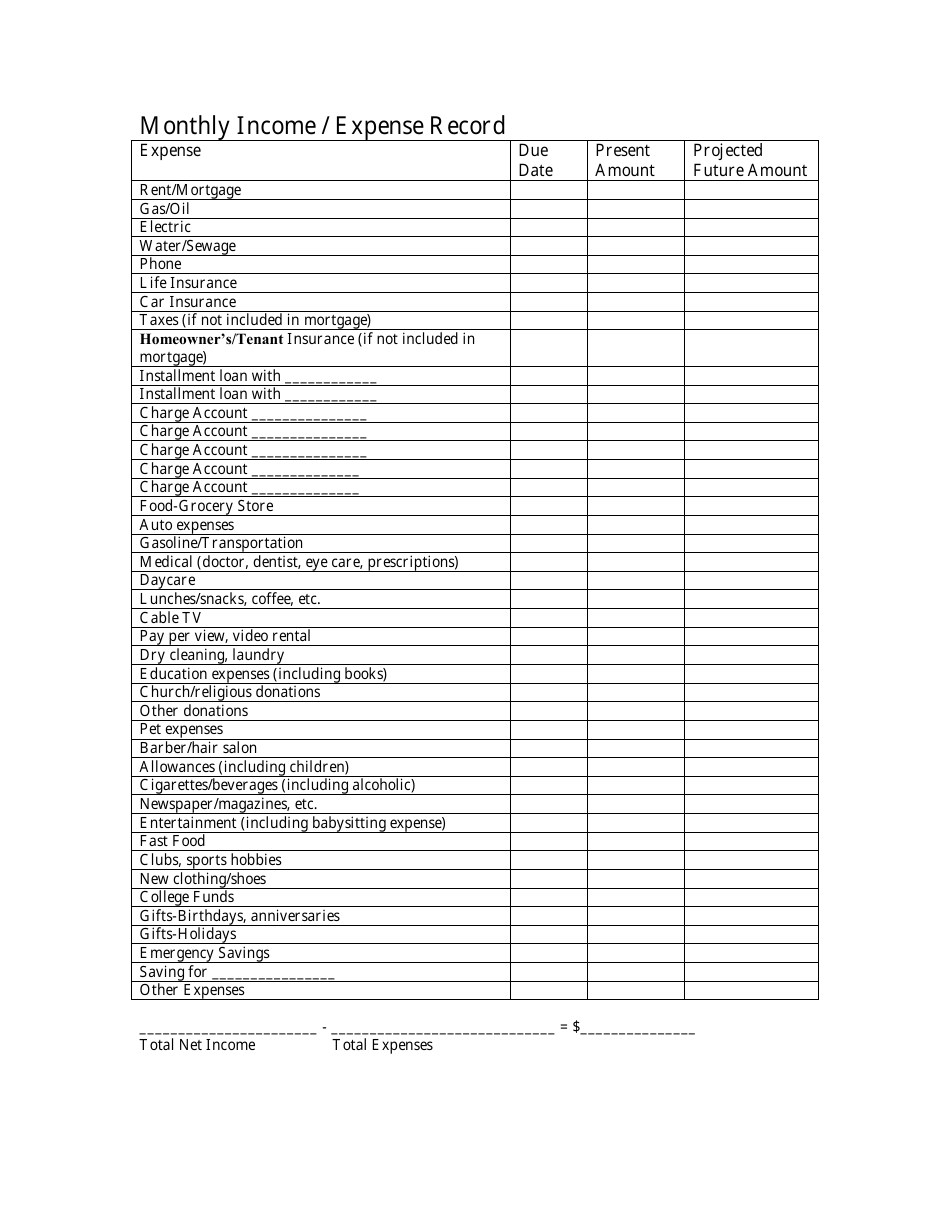

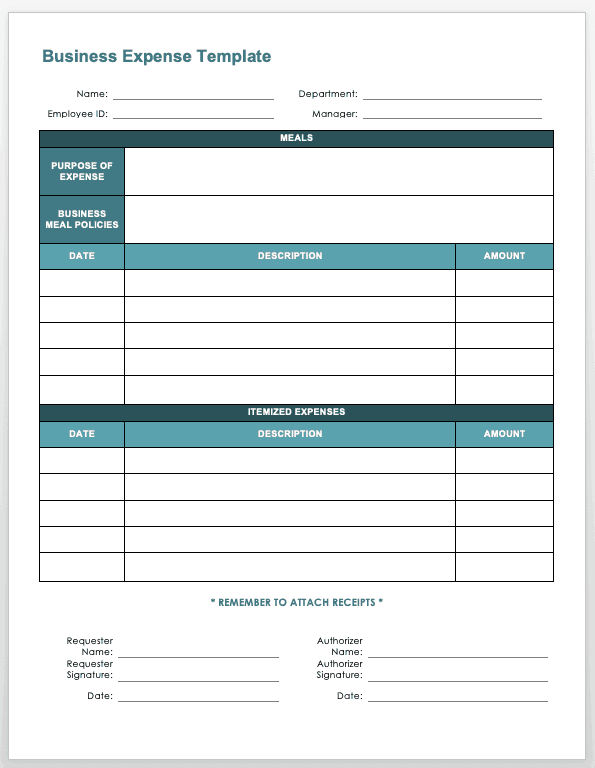

Tax expenses template. Start by choosing your preferred format for the report, or by selecting from one of our free expense report templates. To be considered a qualified medical expense (qme), the expense must be incurred after the hsa is established and must qualify for the medical and dental. It is a standardized form that simplifies the.

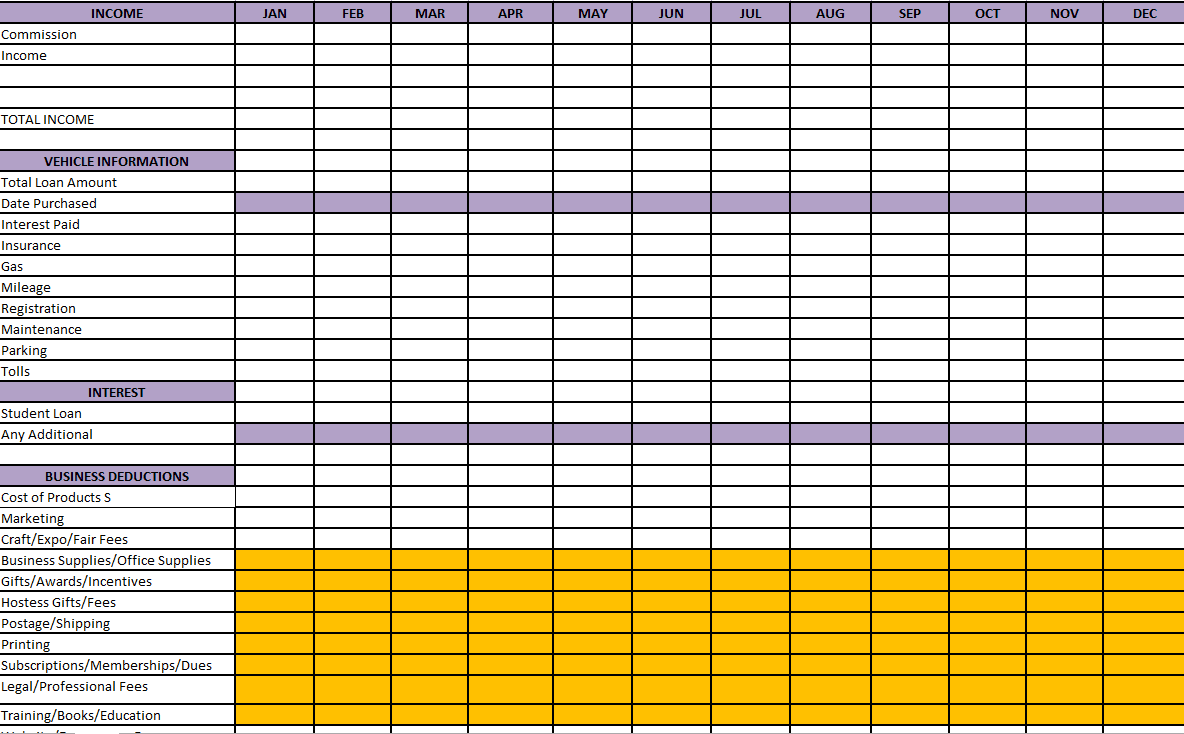

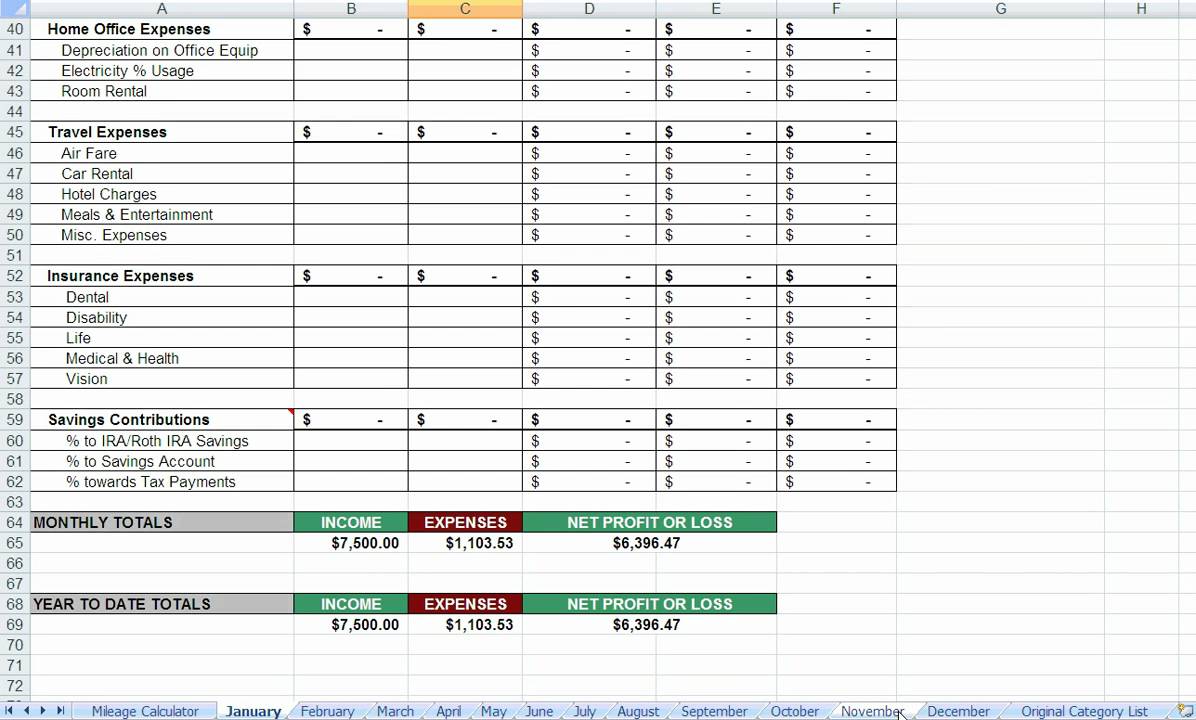

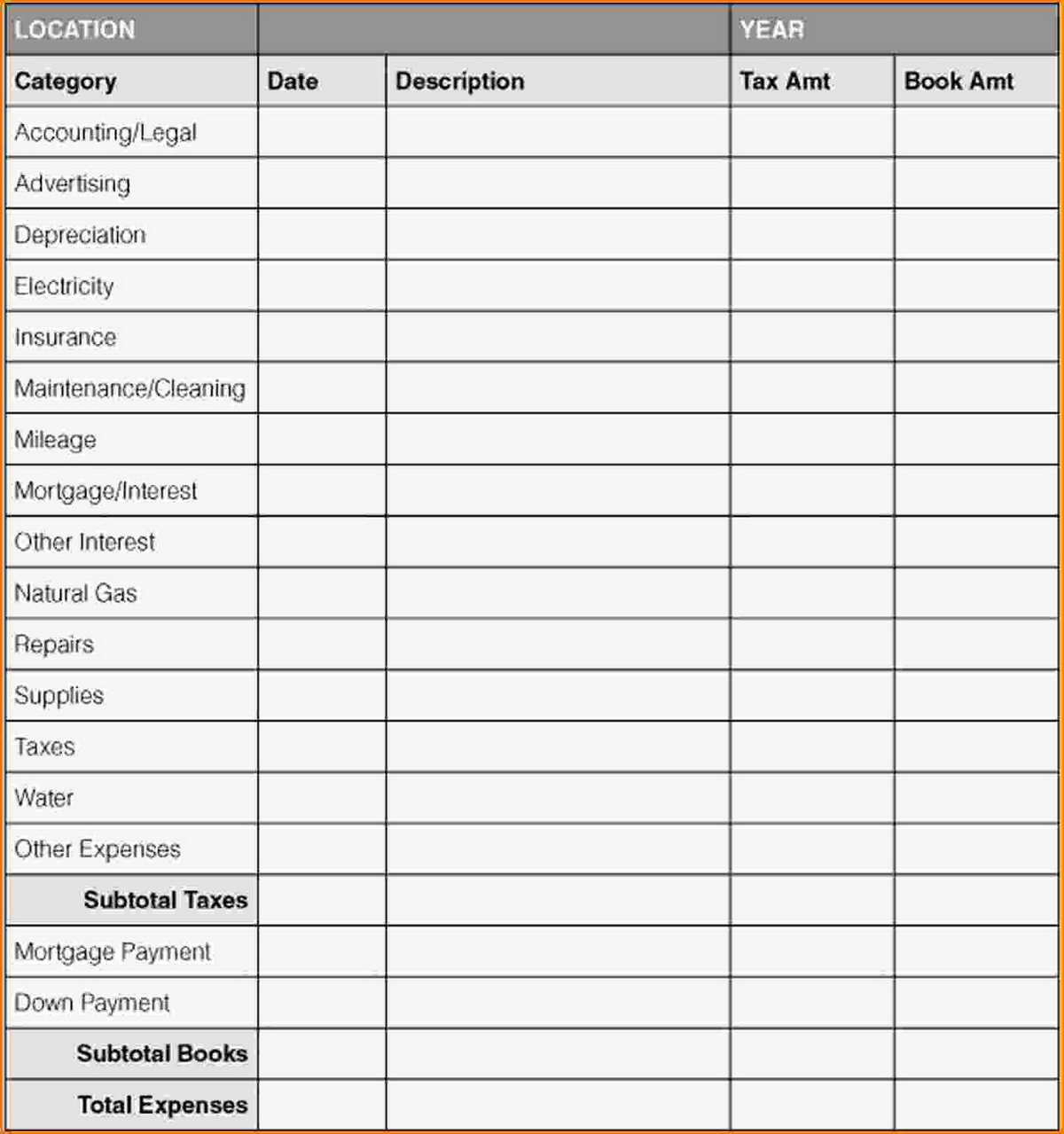

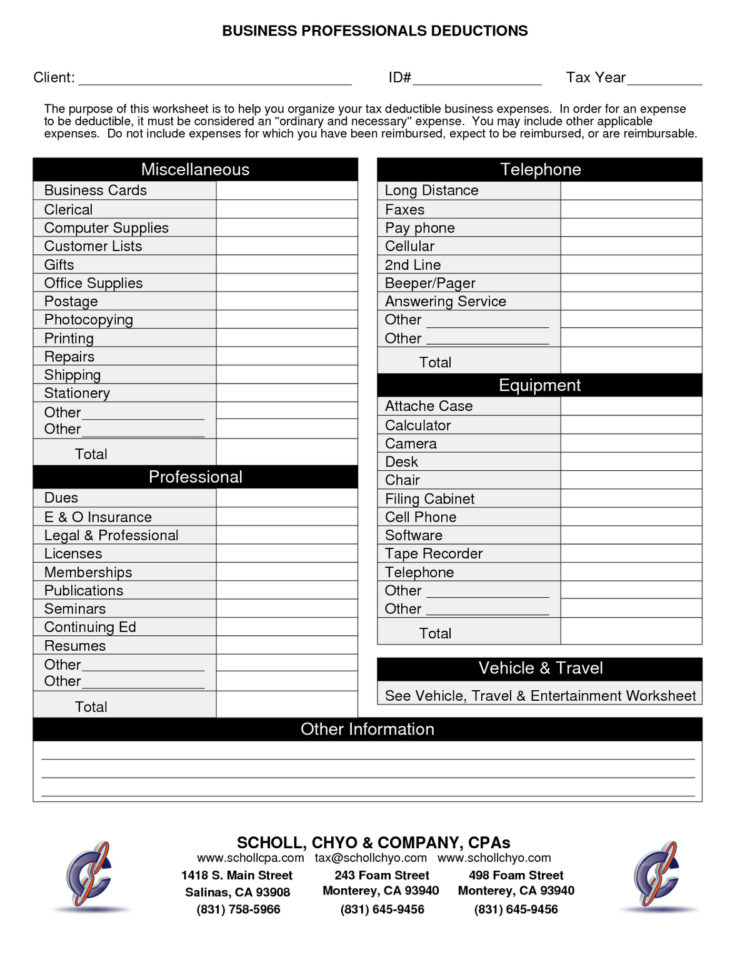

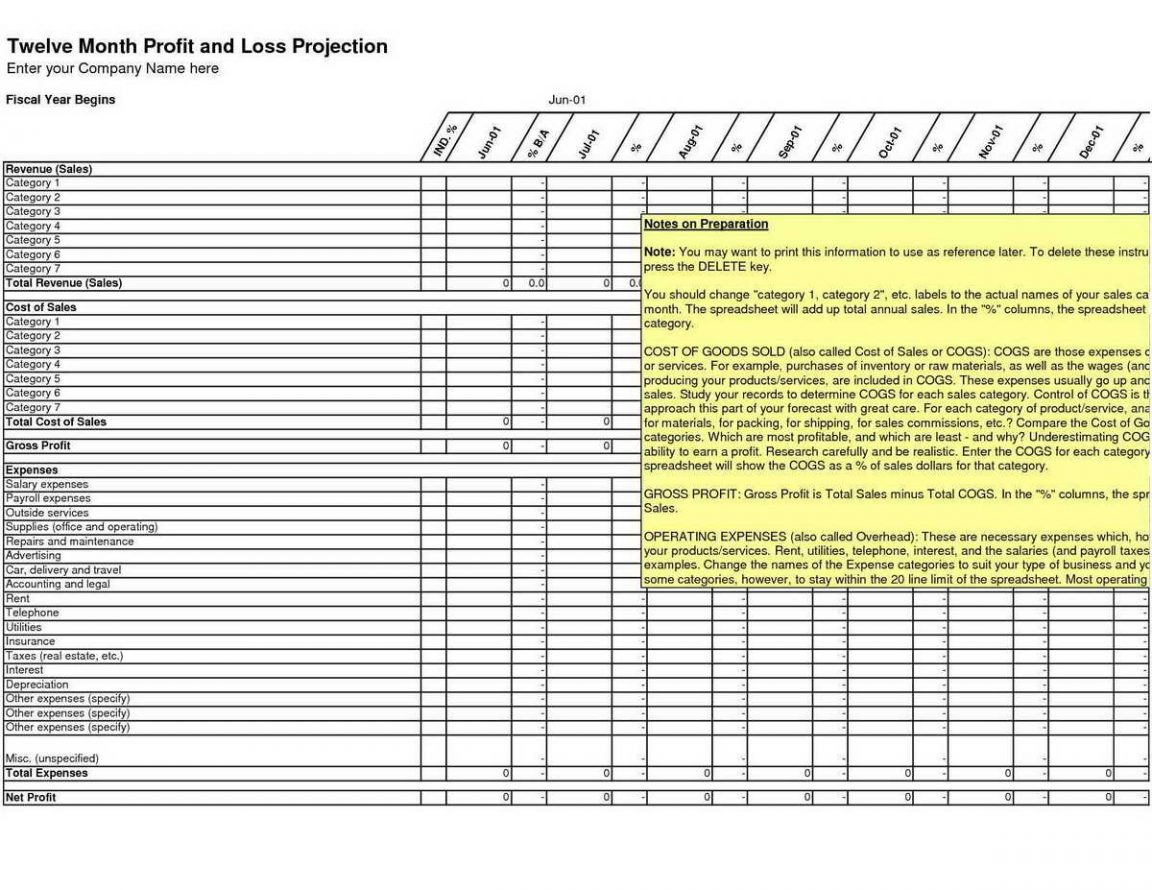

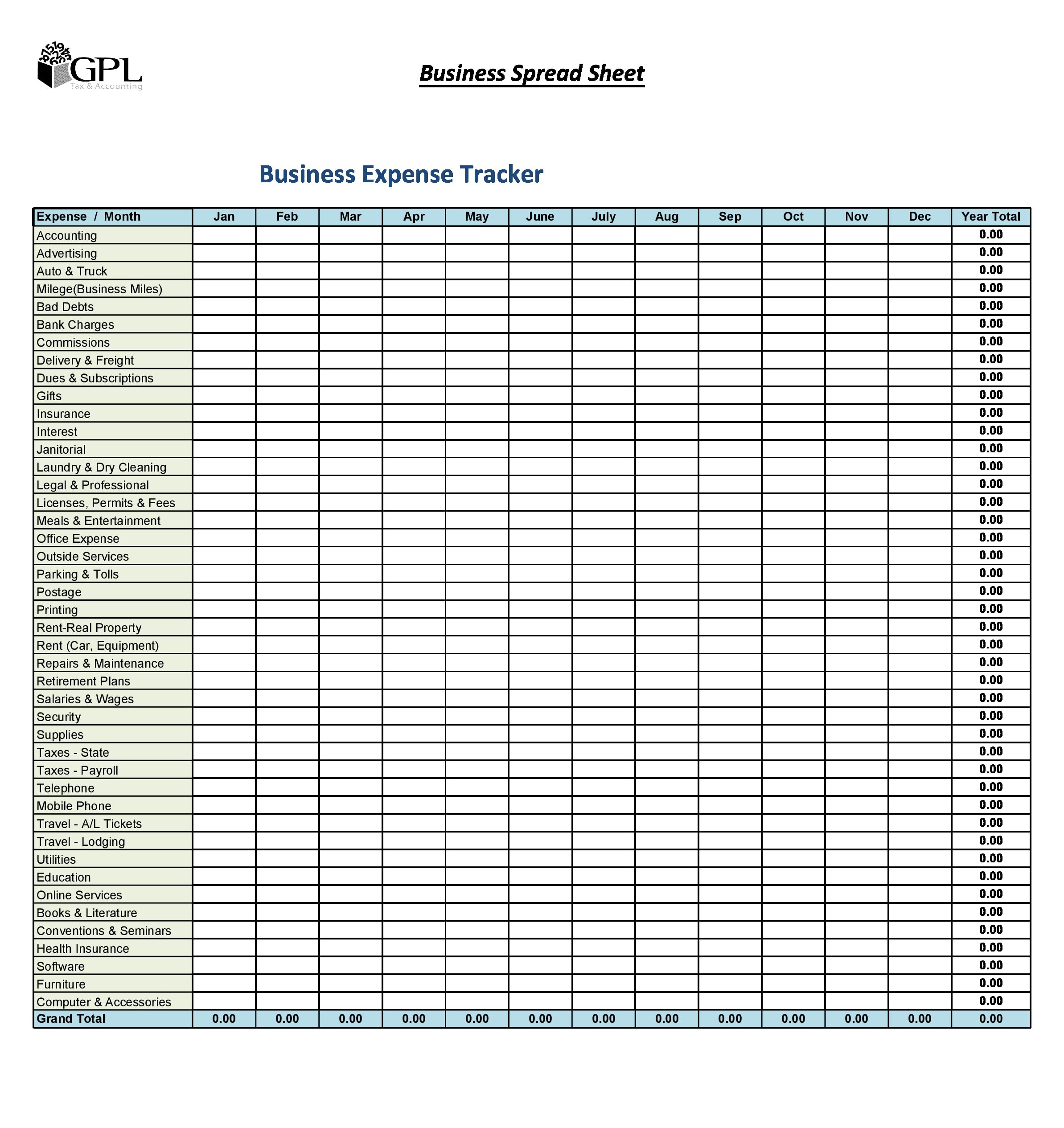

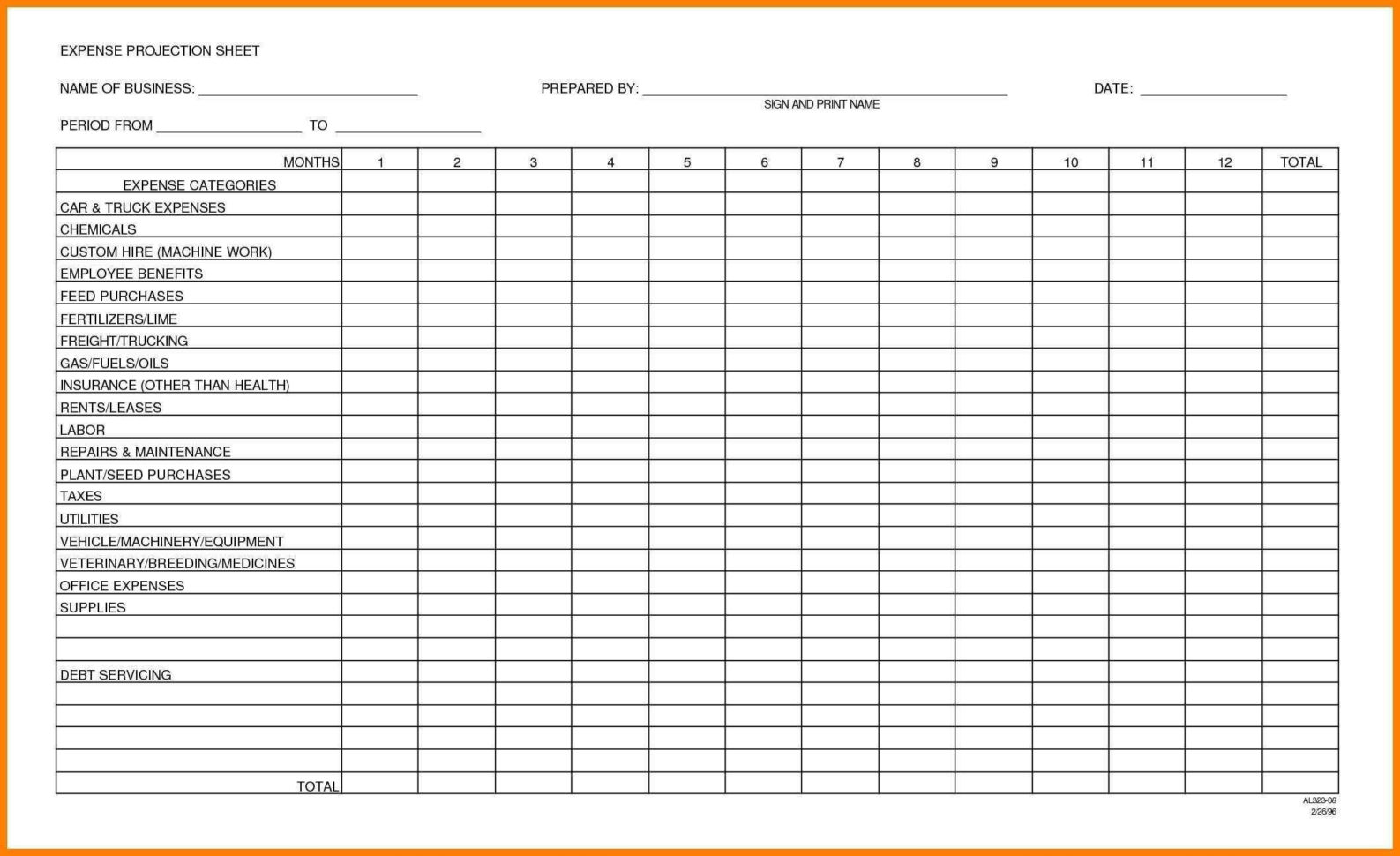

How do small business tax deductions work? Business not registered for gst business registered for gst artists with agents income worksheet work. Streamline your tax preparation with the comprehensive tax expenses spreadsheet template, offering meticulous categorization, calculation, verification, and finalization steps.

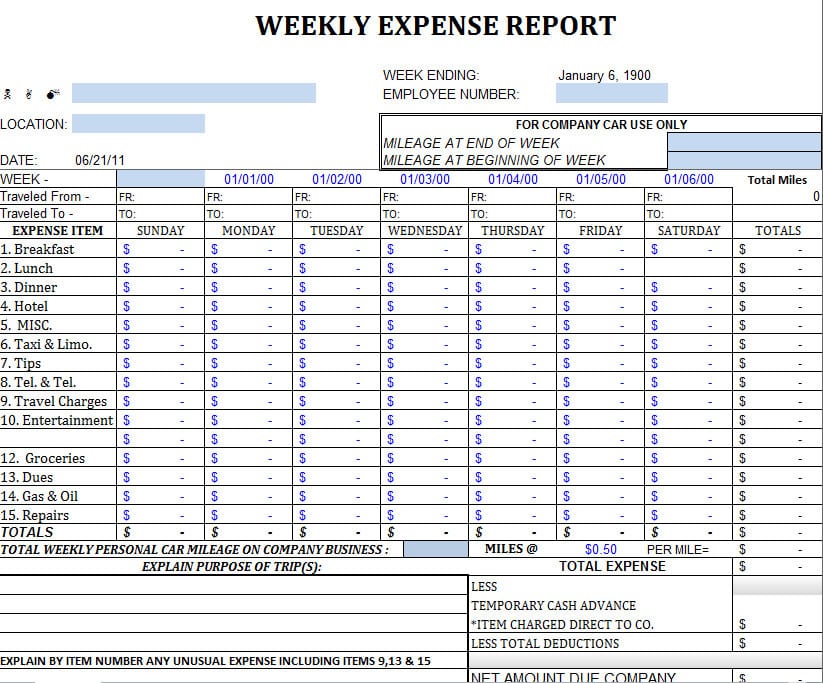

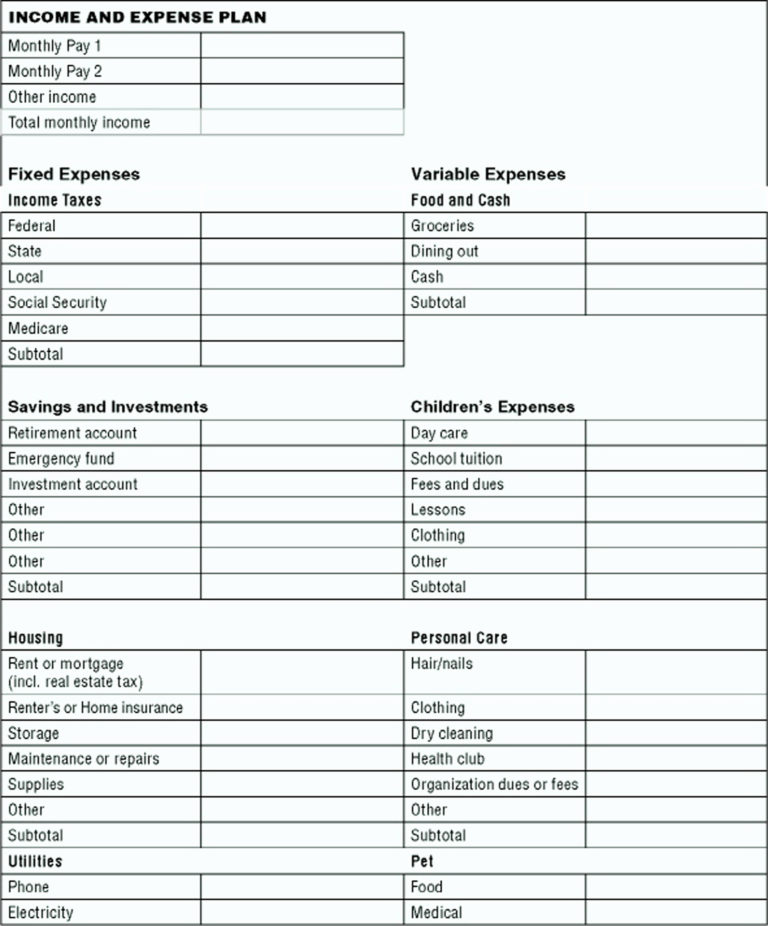

Choose an expense report format. A tax expense is any amount an individual or business owes in taxes to a governing agency. Contents hide 1.

55 small business tax deductions 4. If you pay $100 in real estate taxes and use 10% of your home for business purposes then your home office deduction in relation to your real estate taxes is $10. Click on the titles below to download suggested templates:

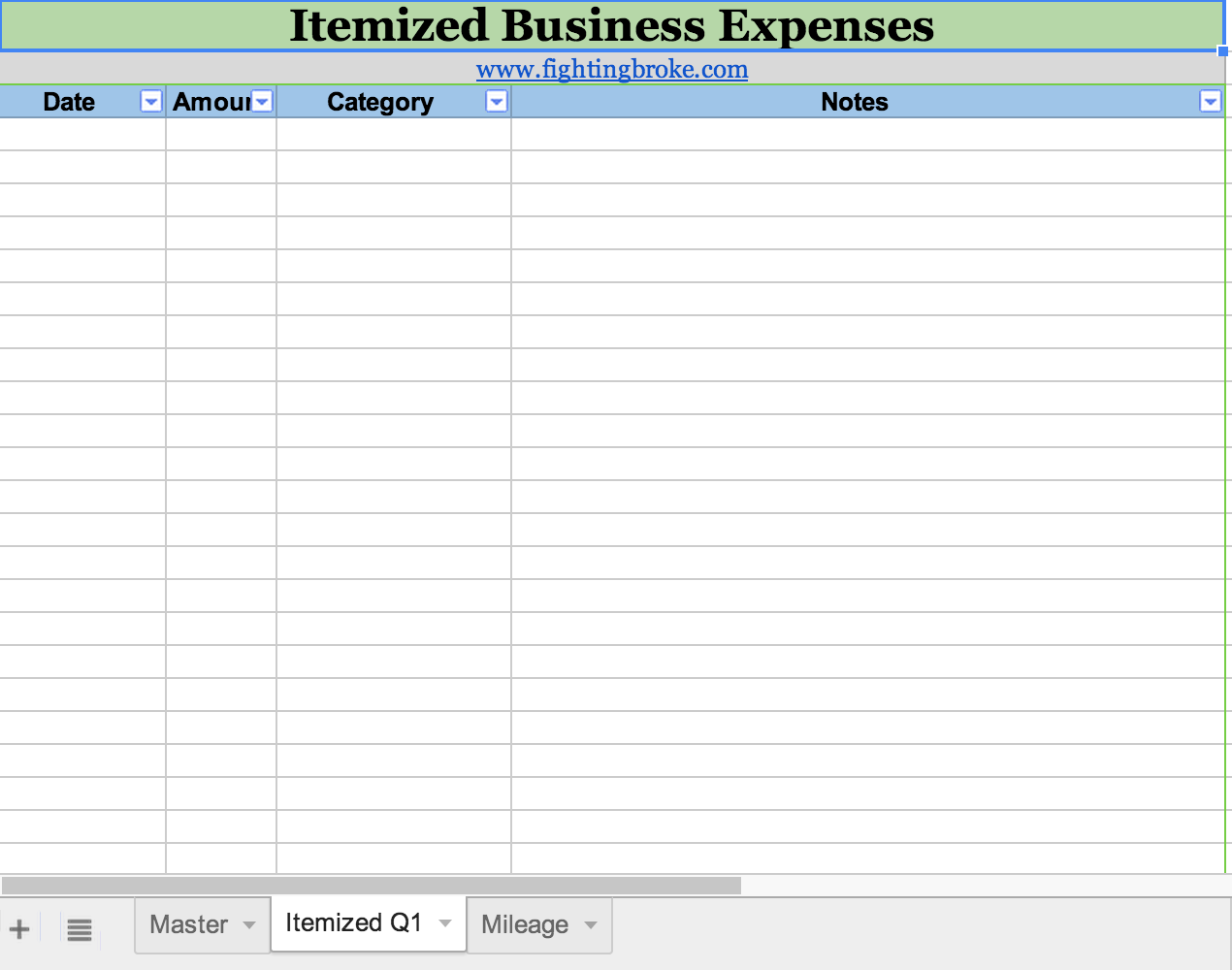

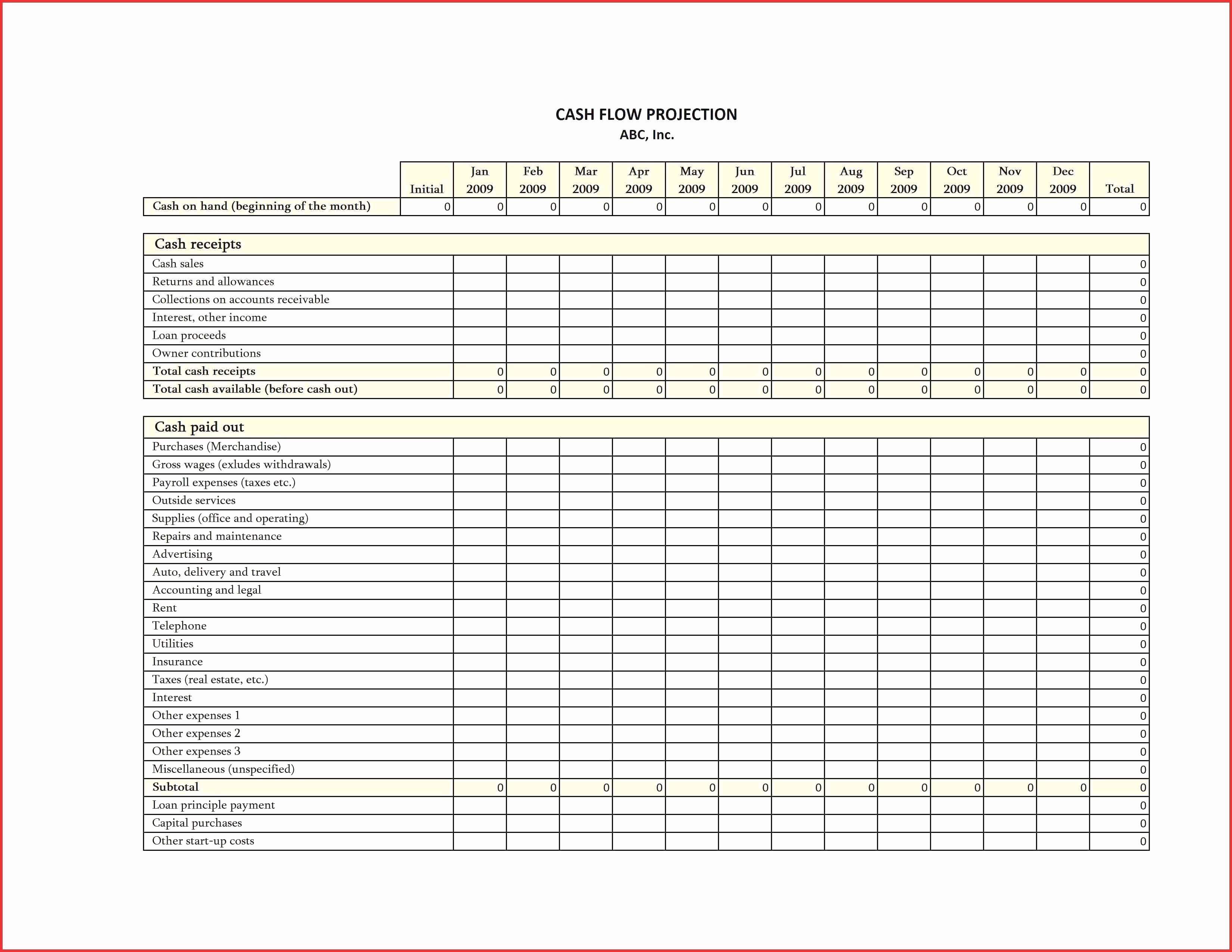

They can also deduct expenses for 1099 contractors. We’ll get you on track to sort your 2020/21 tax return. How to use excel templates?

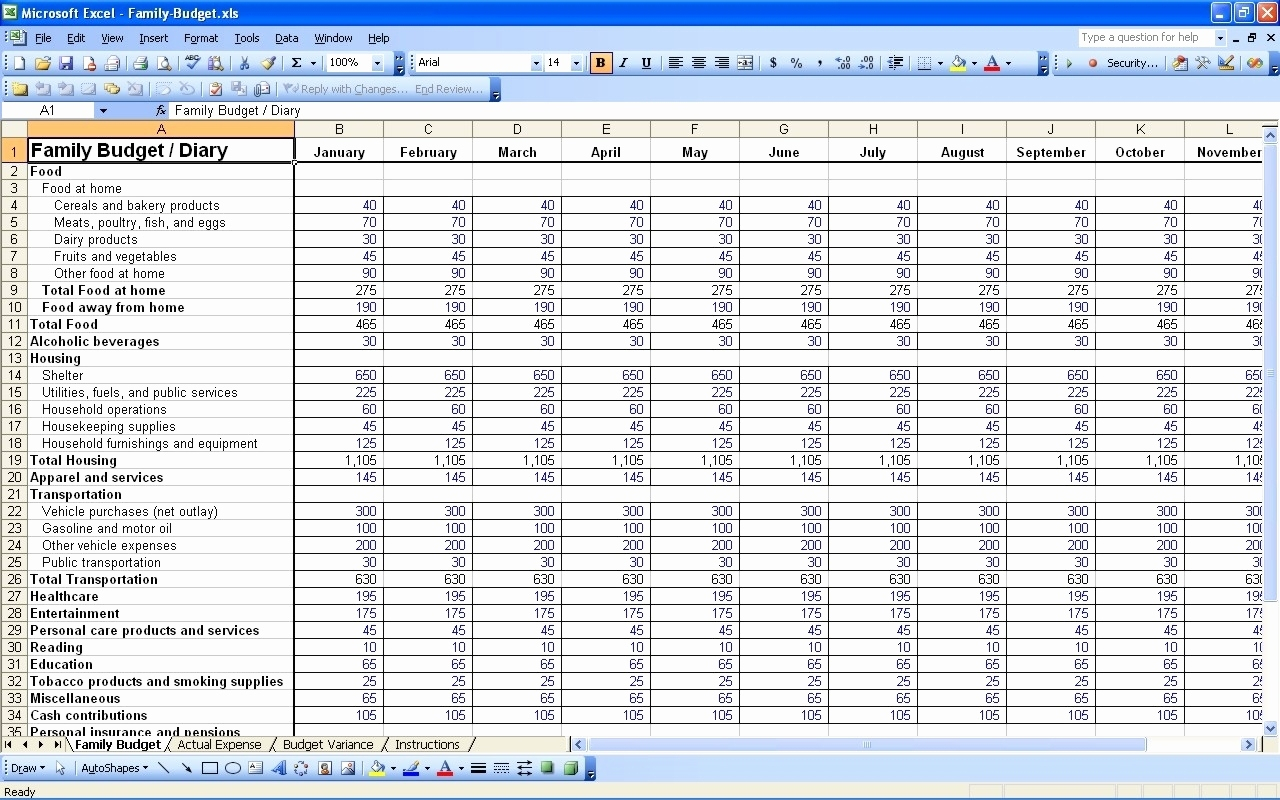

Excel can be used to create a tax expense template, which entails populating a spreadsheet with formulas to determine tax liability in light of one’s income. What is a tax deduction? Easily editable, printable, downloadable.

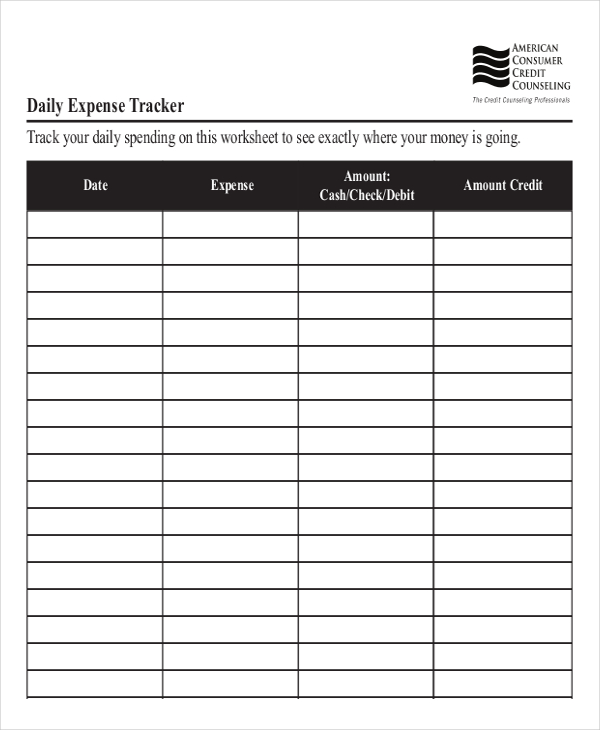

Who should you consult to. Top expense tracking templates in excel for free; A small business expense report template is a tool to track daily or weekly expenses.

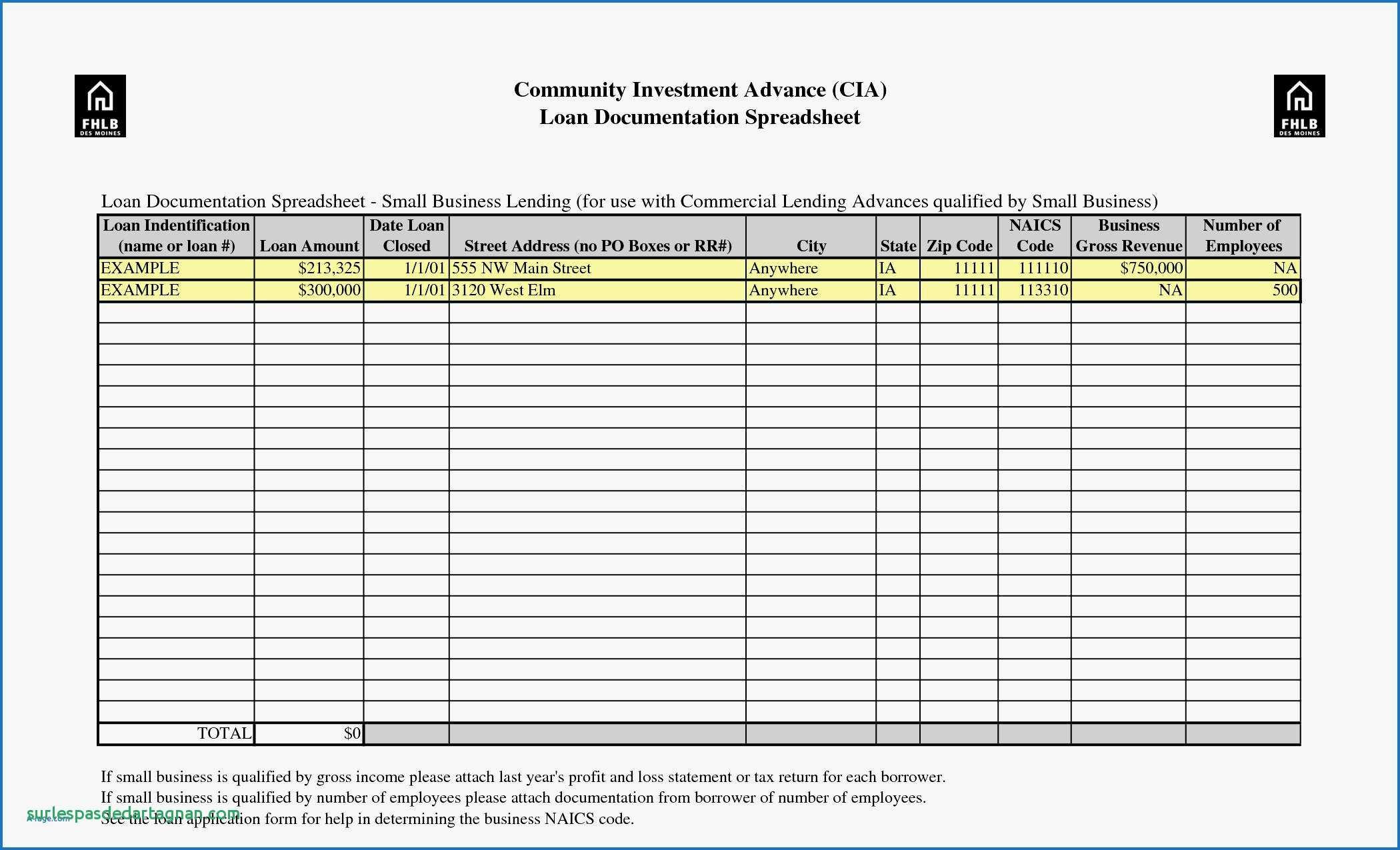

In connection with an erc refund for 2020 or 2021, the company (and in some cases, its owners) is required to amend corporate and individual income tax returns to. A free template to track your home office expenses and calculate your tax savings.