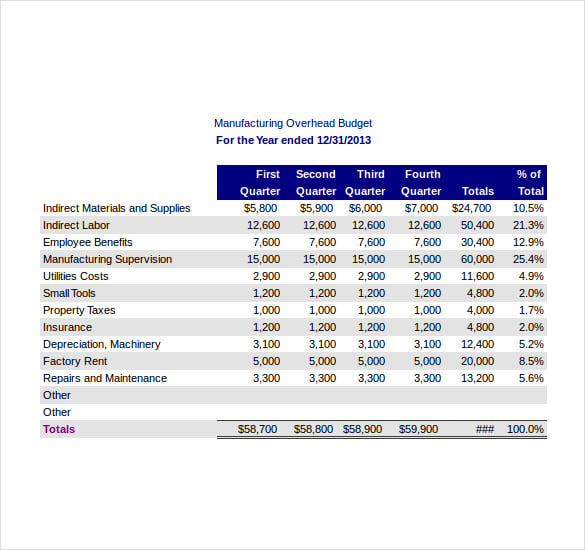

Recommendation Tips About Manufacturing Cost Calculation Template

![Cost of Goods Sold Calculator [Updated] Excel Templates](https://i.ytimg.com/vi/E7reZLInTxA/maxresdefault.jpg)

Thus, your total manufacturing cost for one unit.

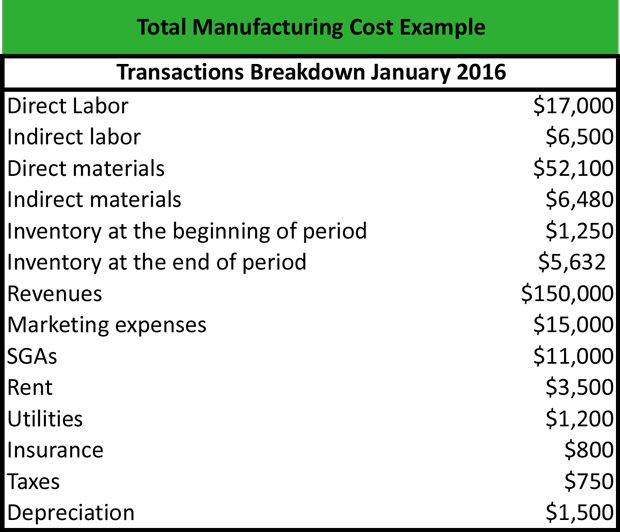

Manufacturing cost calculation template. The formula for calculating the planned ratio is the production cost price in monetary terms / purchase price. Use the given data for the. Total manufacturing costs = raw materials + direct labor +allocated manufacturing overhead56 = (20+10+16) + 10 + 10.

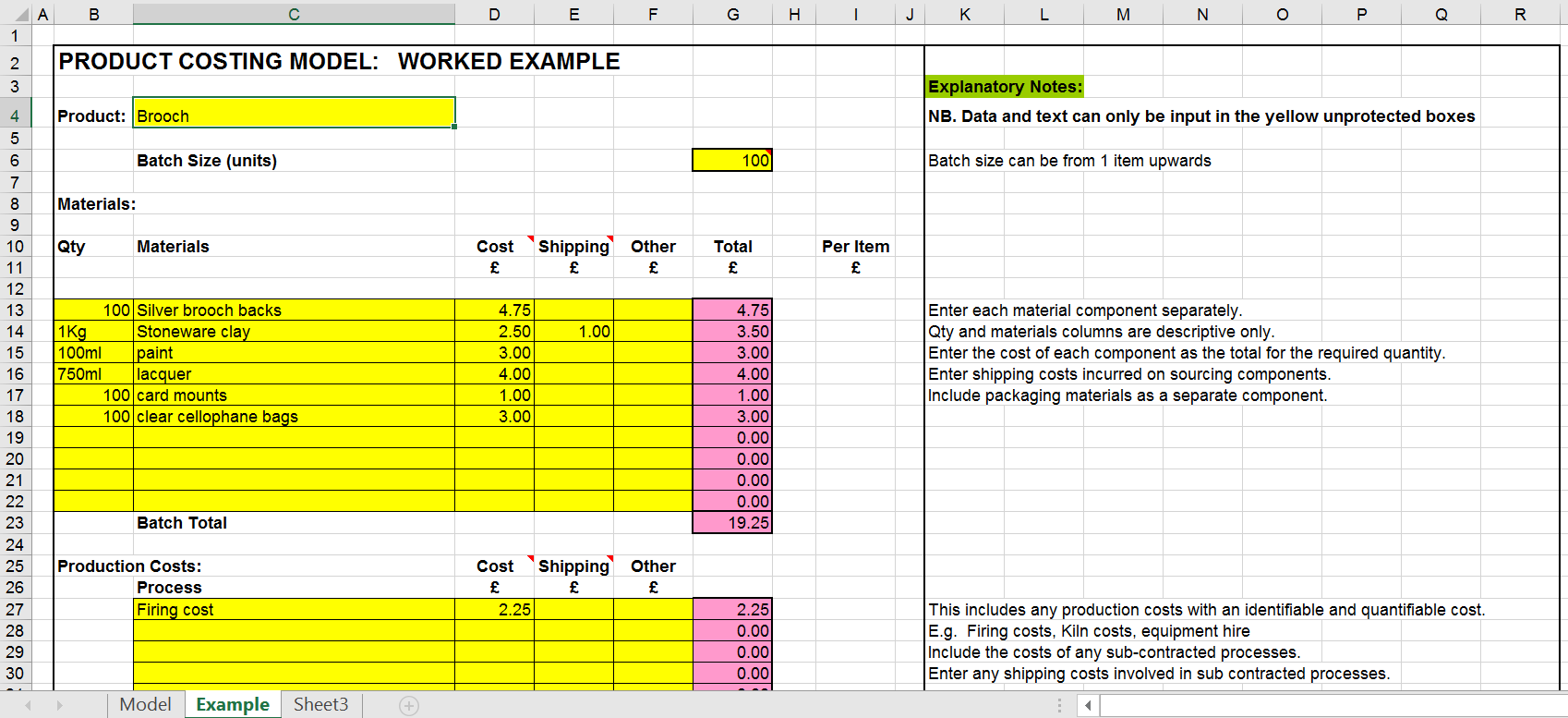

If we incorporate those inputs into our wip model, the cost of manufactured products comes. Total manufacturing cost formula. Cost of goods manufactured excel template.

Ending work in progress (wip) = $45 million. The level of costs for the. It incurs $30,000 in manufacturing overheads and $50,000 in direct material costs.

To determine the total manufacturing cost for the production of your finished product, add the direct materials cost with the. First, we need to reach the direct labor cost. For the calculation we use the formula:

As a manufactory owner, you really want to know how to calculate the manufactory cost. Help the business to determine the overall cost of production. Total manufacturing cost = direct costs (dc) + indirect costs (ic) where:

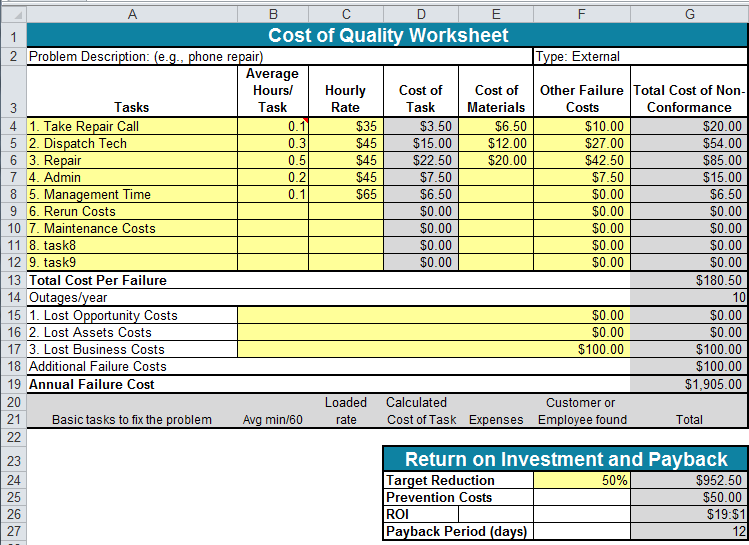

Add up the other direct expenses step #4: The formula is as follows: How to calculate manufacturing cost in 5 steps indeed editorial team updated march 10, 2023 manufacturing costs are an important metric to consider for.

The purchase price + transport costs in monetary terms + duty in monetary terms. Compute the cost of direct labor step #3: Manufacturing costs = $40 million.

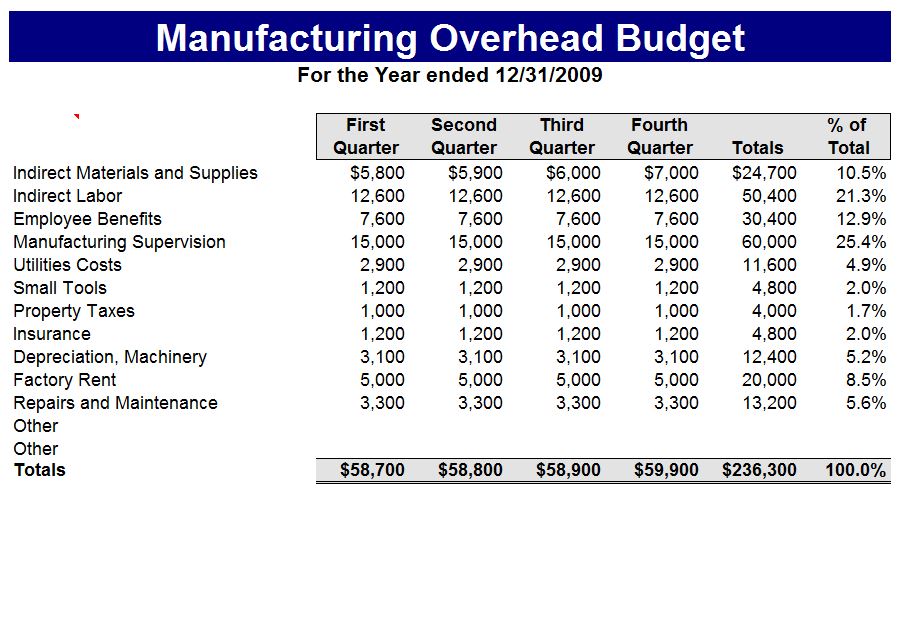

Several basic templates are available for microsoft excel that make it simple to calculate production costs. This product costs template will help break down the product costs into the costs of direct material (dm), direct labor, and manufacturing overhead (moh). Calculate the cost of direct materials step #2:

The cost of goods manufactured excel template is a helpful tool for manufacturers to track and analyze. The formula for calculating the total manufacturing cost is as follows: Manufacturing overhead cost is calculated using the formula given below manufacturing overhead cost = indirect material cost + indirect labor cost +.

Calculate the cost of goods manufactured:

![Cost of Goods Sold Calculator [Updated] Excel Templates](https://exceltemplate.net/wp-content/uploads/2009/07/CoGS-Calculator-Spreadsheet.jpg)