Inspirating Info About Free Printable Debt Snowball Worksheet

This free printable debt snowball worksheet is pretty easy to use.

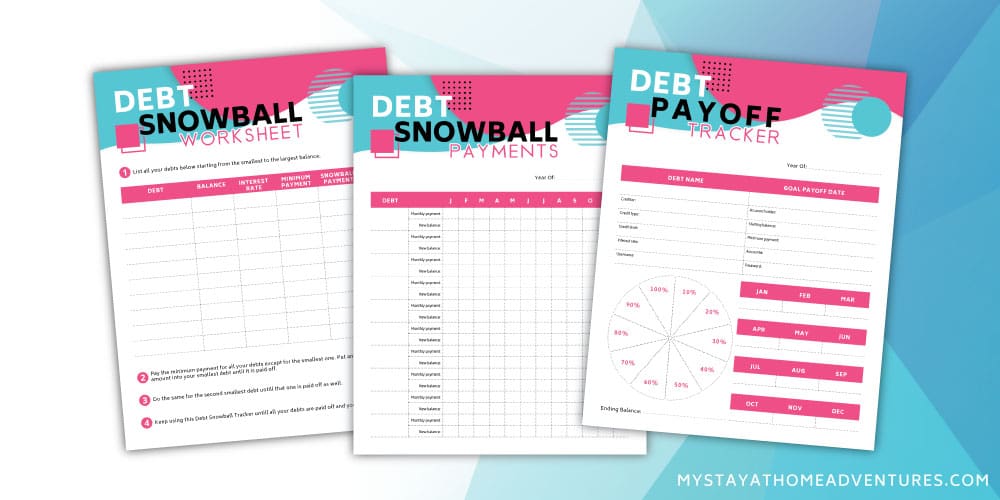

Free printable debt snowball worksheet. Conquer your debt with these free printables. Download the debt snowball worksheet from ramsey to list all of your debts smallest to largest and mark them off one by one. Three debt snowball coloring sheets for debt priority, snowball payments, and snowball tracker.

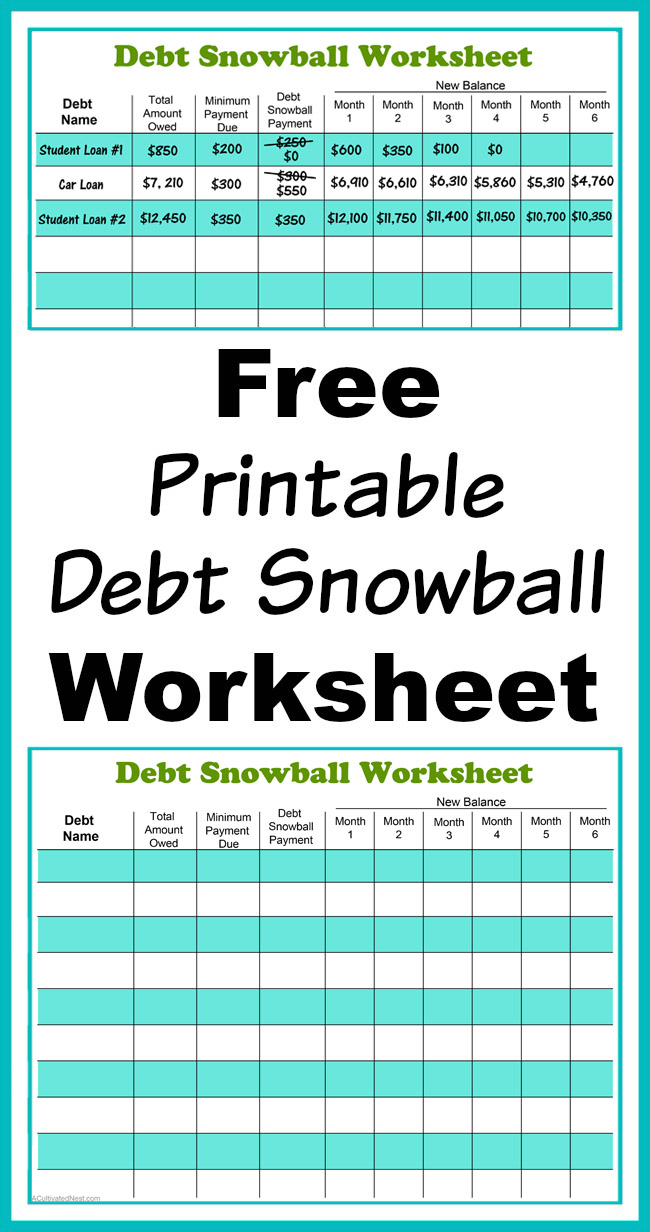

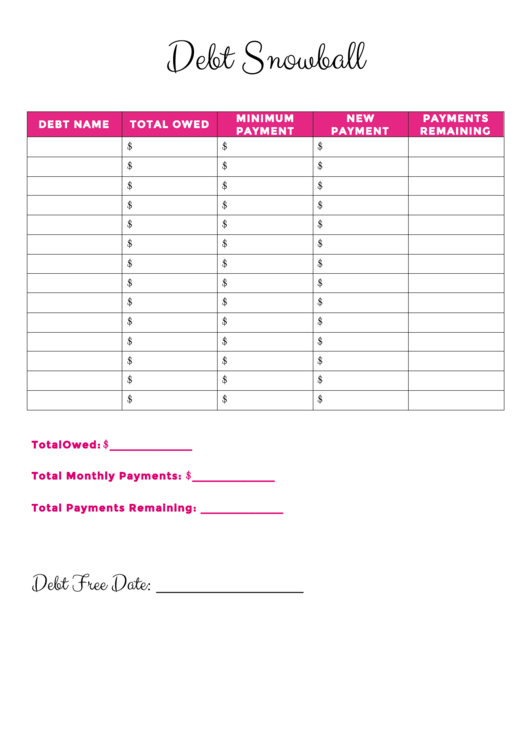

Write each one of your debts down on this form in order from smallest to largest. There is no day like today to get your debt snowball rolling. Example of the debt snowball worksheet filled out:

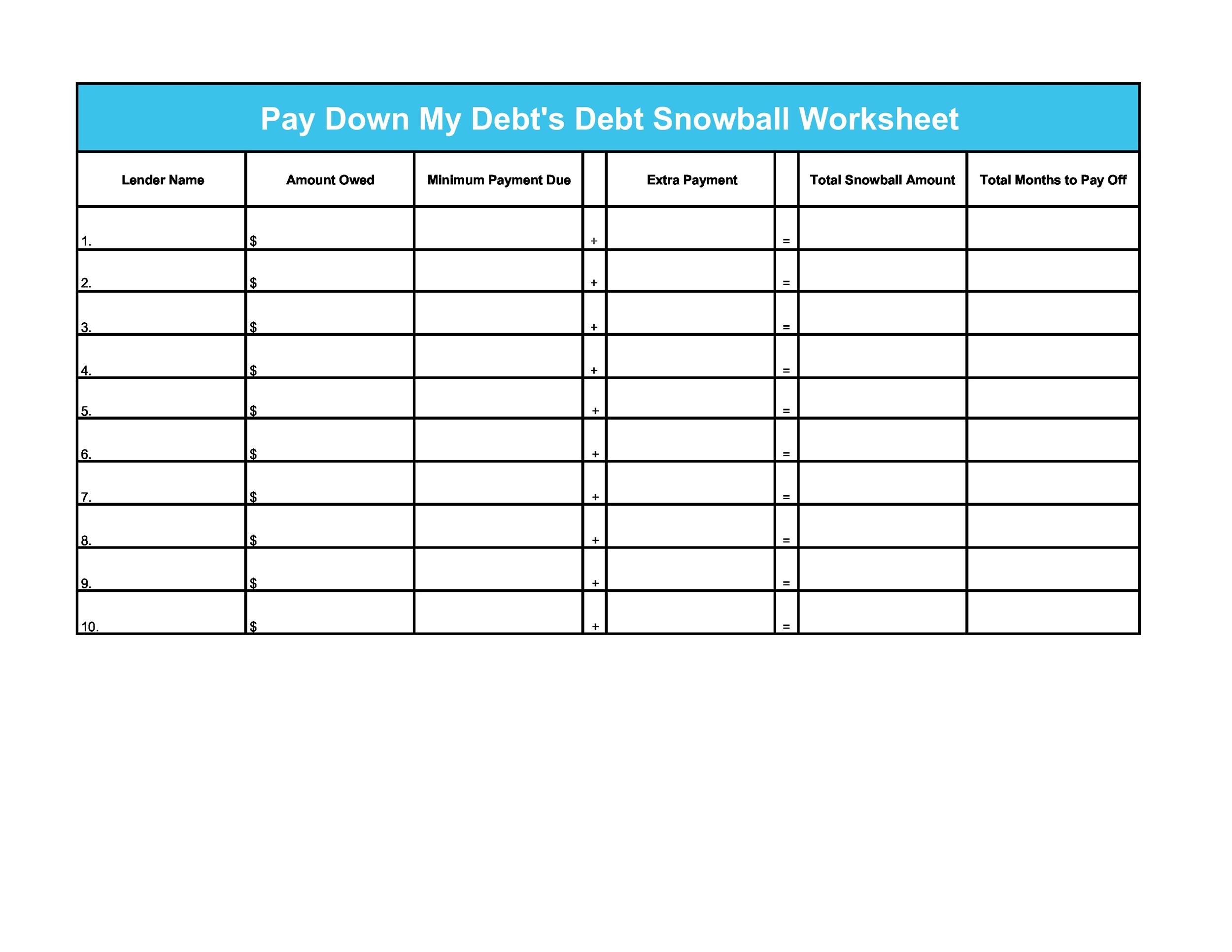

3 printables over 3 days! The first free printable debt snowball worksheet is a tracking sheet. With the debt snowball method, you simply start with the smallest debt first, and so you would order.

So here are some of the best. Grab these free printable debt payoff planner pages to help you track as you pay down your debt so. 1 list all your debts below starting from the smallest to the largest balance.

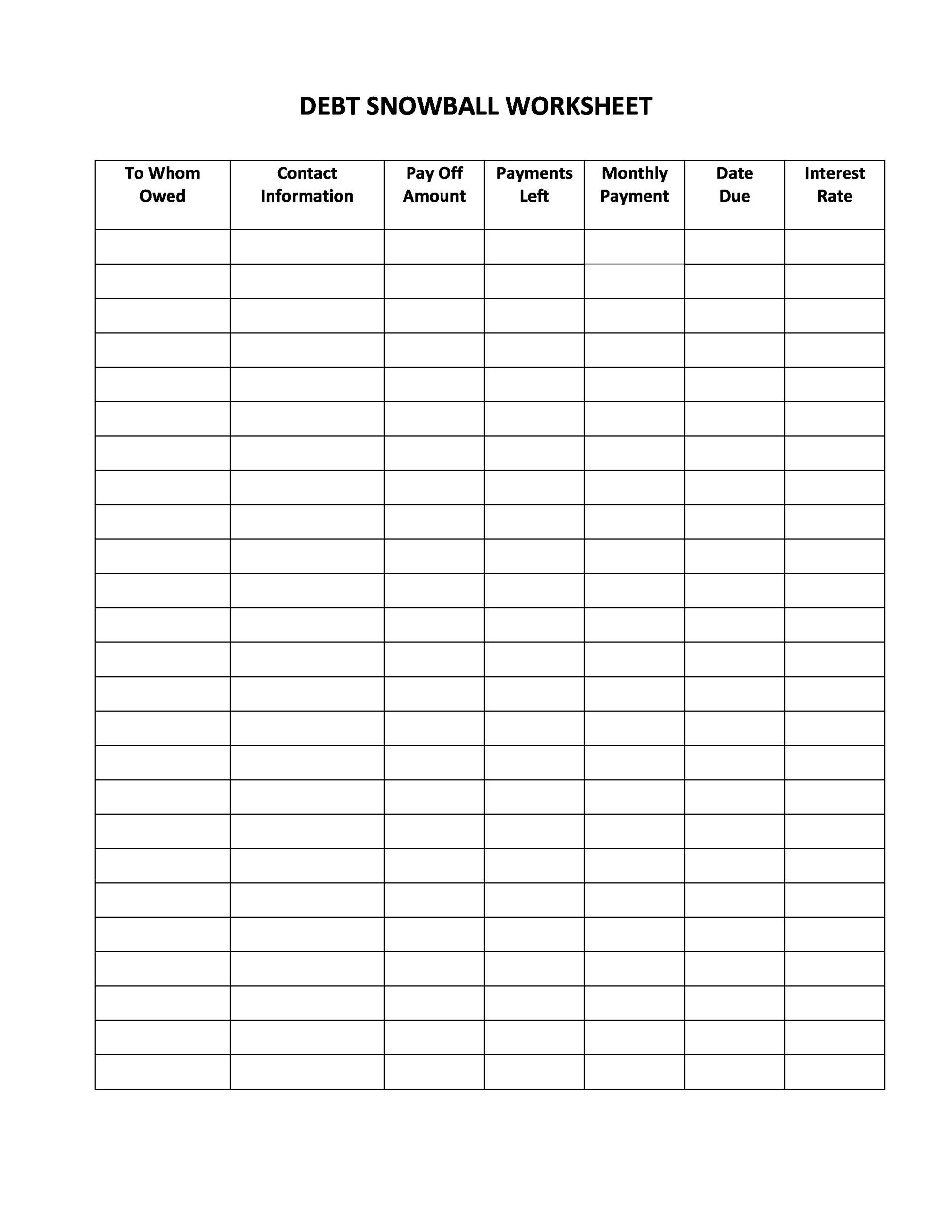

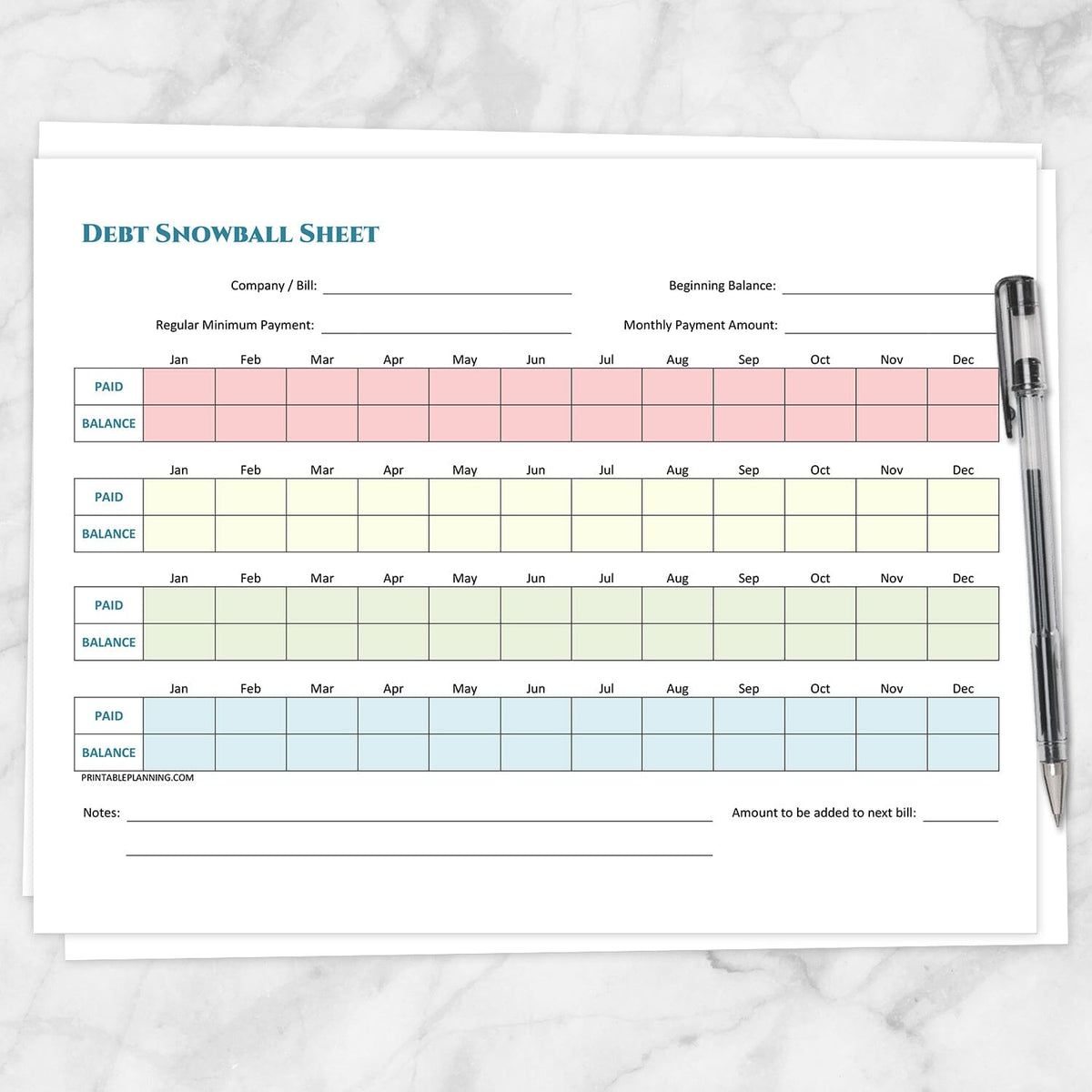

This form helps you prioritize your debts and. Snowball worksheet month debt name acultivatednest.com minimum payment due debt month snowball payment month new balance month month month. In this article, we’ll detail what a debt snowball method is, how it works, and how to create a debt snowball spreadsheet in google sheets.

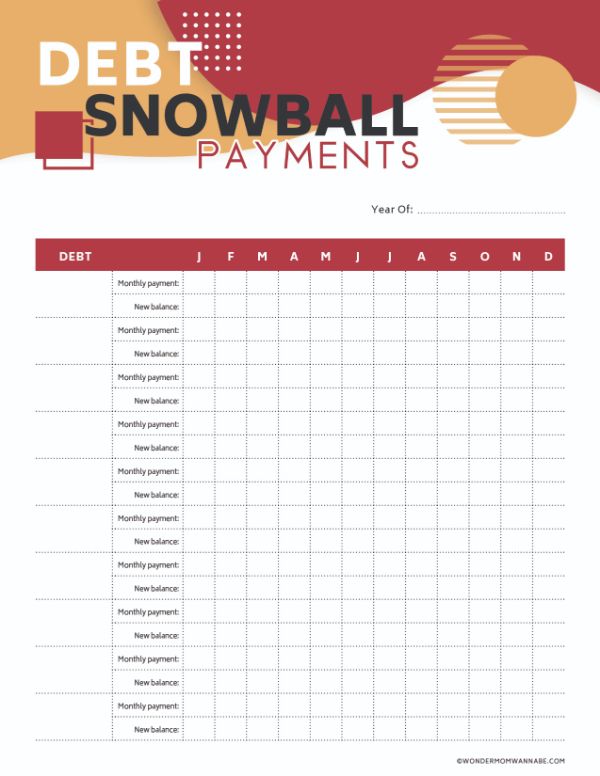

Free printable debt payoff planner. 2 pay the minimum amount into 3 do the same 4 keep using debt j f m a m j j a s o n d. There is a debt priority worksheet to help you figure out which debt to attack first.

On the left you write in the names of all your different debt sources, like “credit cardx”, “car loan”, “student. 1 shares this article may contain affiliate links that helps support this website. For those who want a fun and creative way to tackle debt.

One option on this list. A debts snowball payments sheet to record your debt payments, and a debt payoff visual that you can fill out. Free debt snowball spreadsheets for 2024 a spreadsheet is one of the most helpful tools for planning the best debt payoff strategy for your situation.

How do you figure out which one to focus on paying off first?