Ace Tips About Double Entry Accounting Template

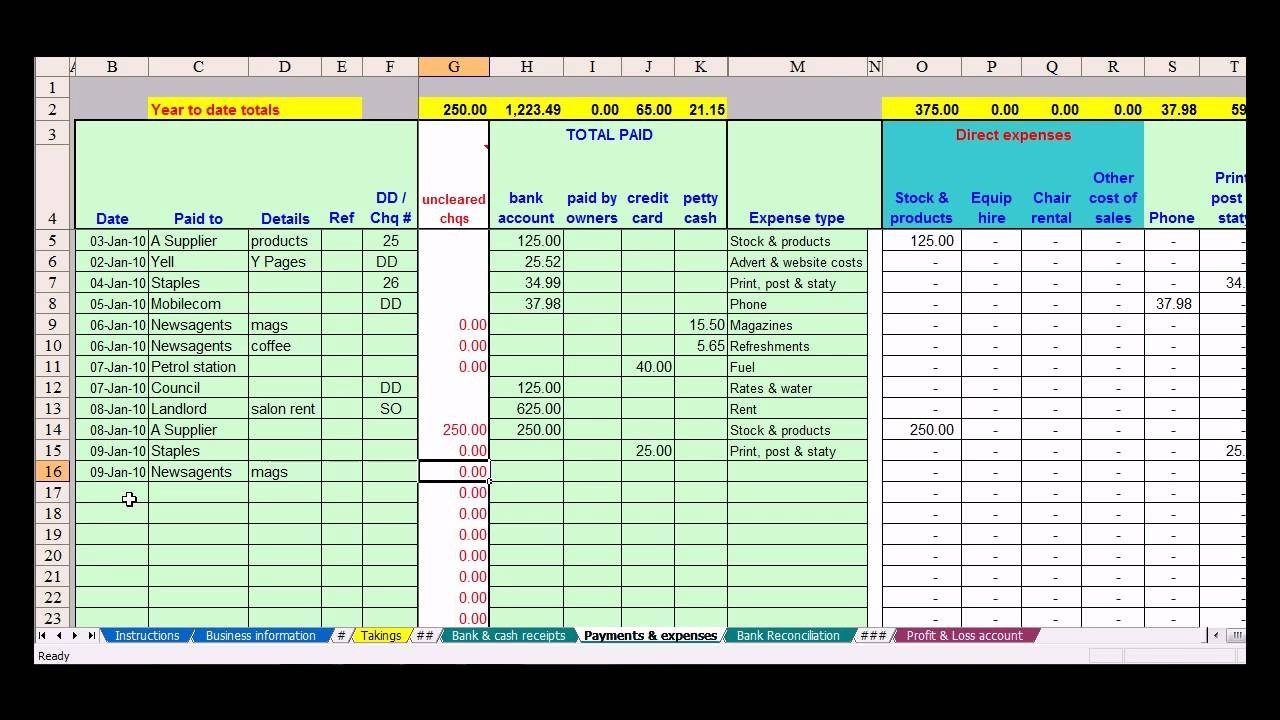

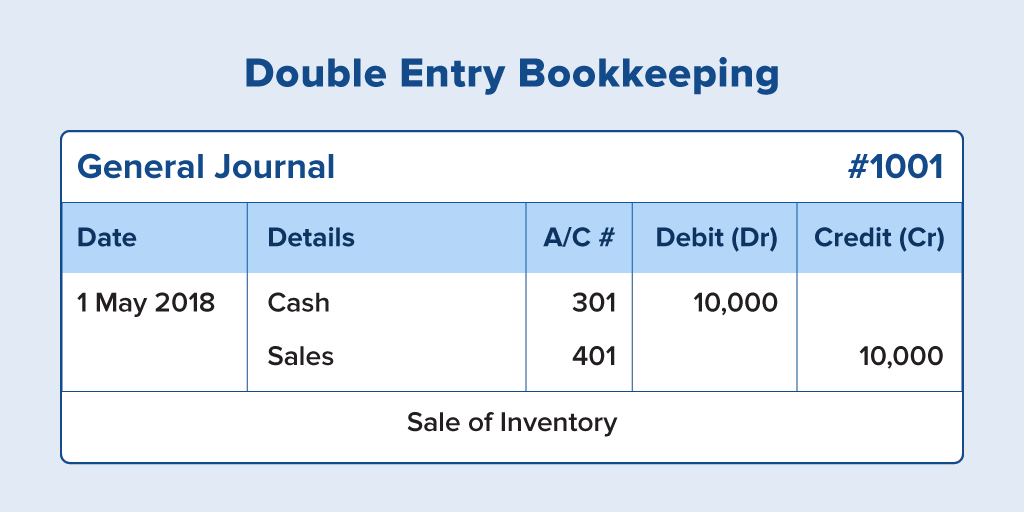

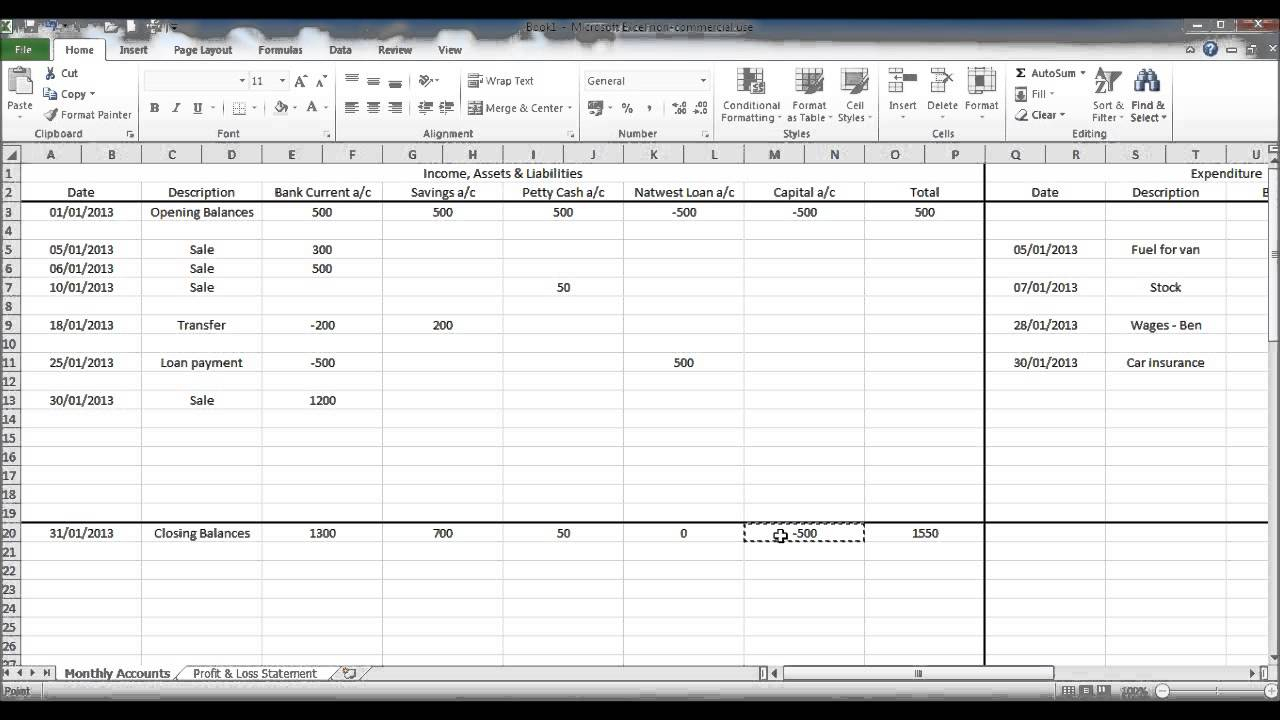

Enter all transactions using debits and credits.

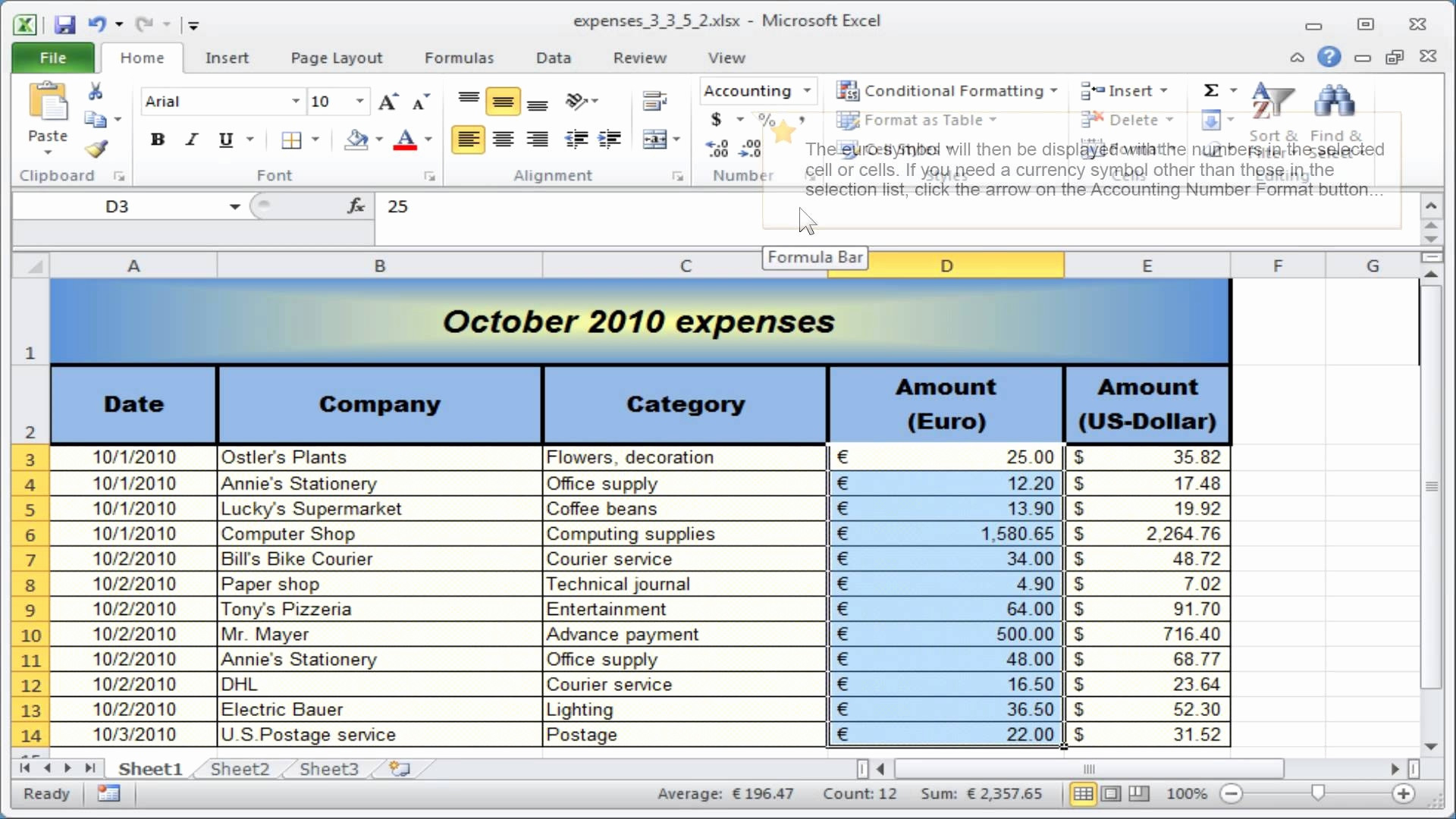

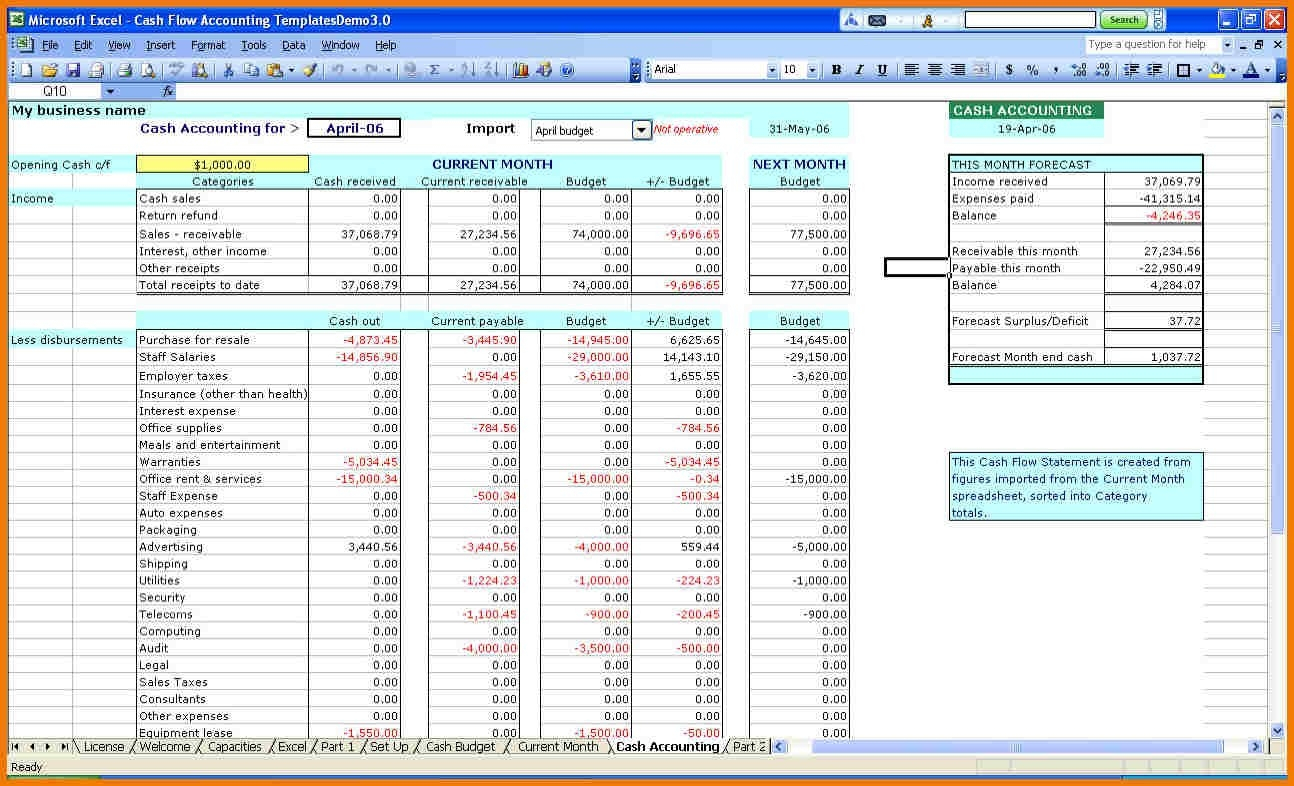

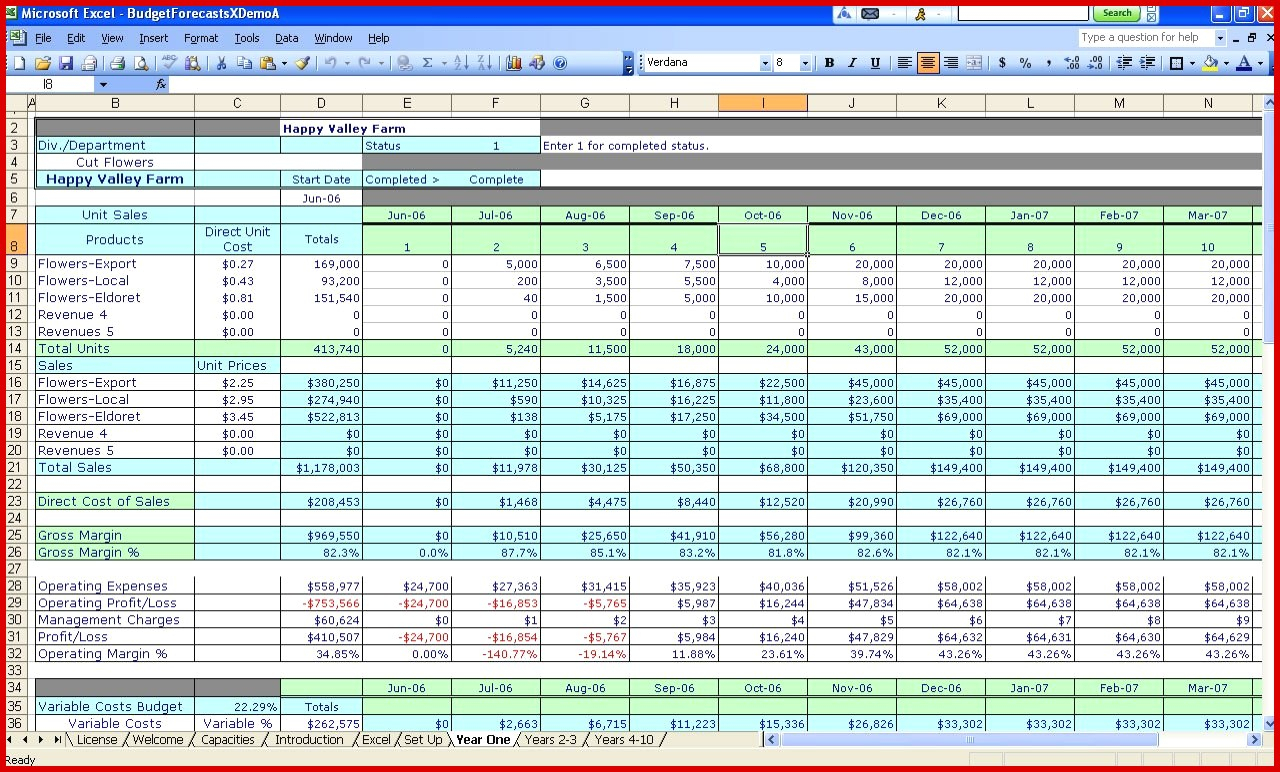

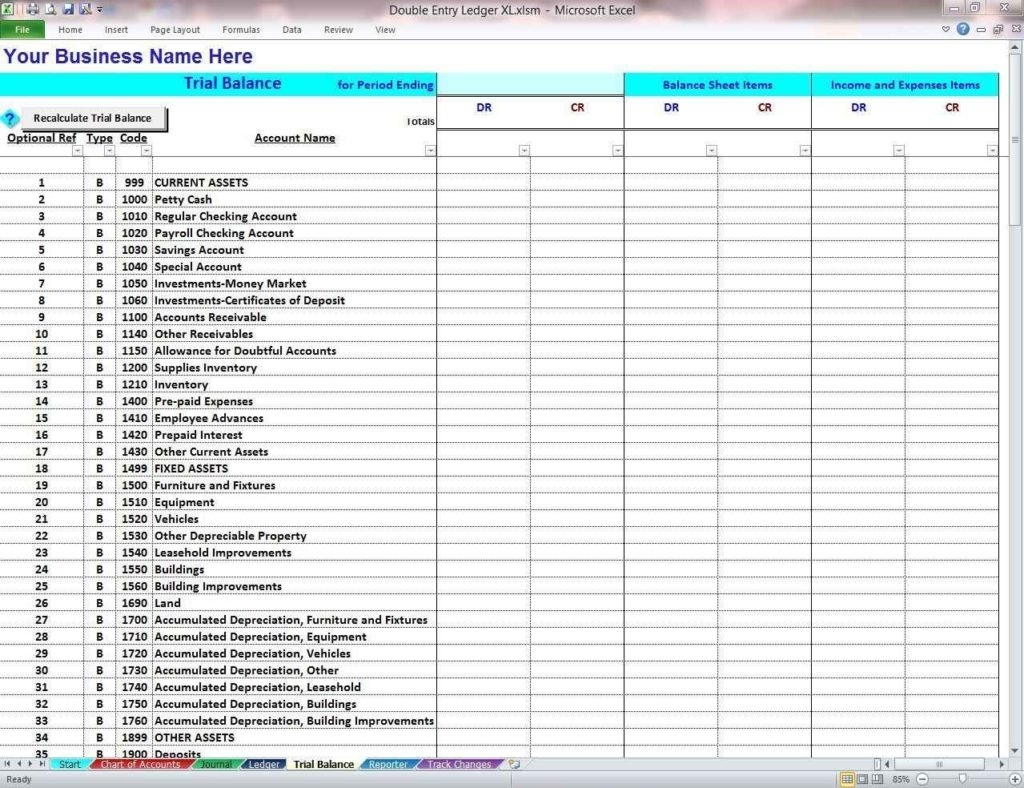

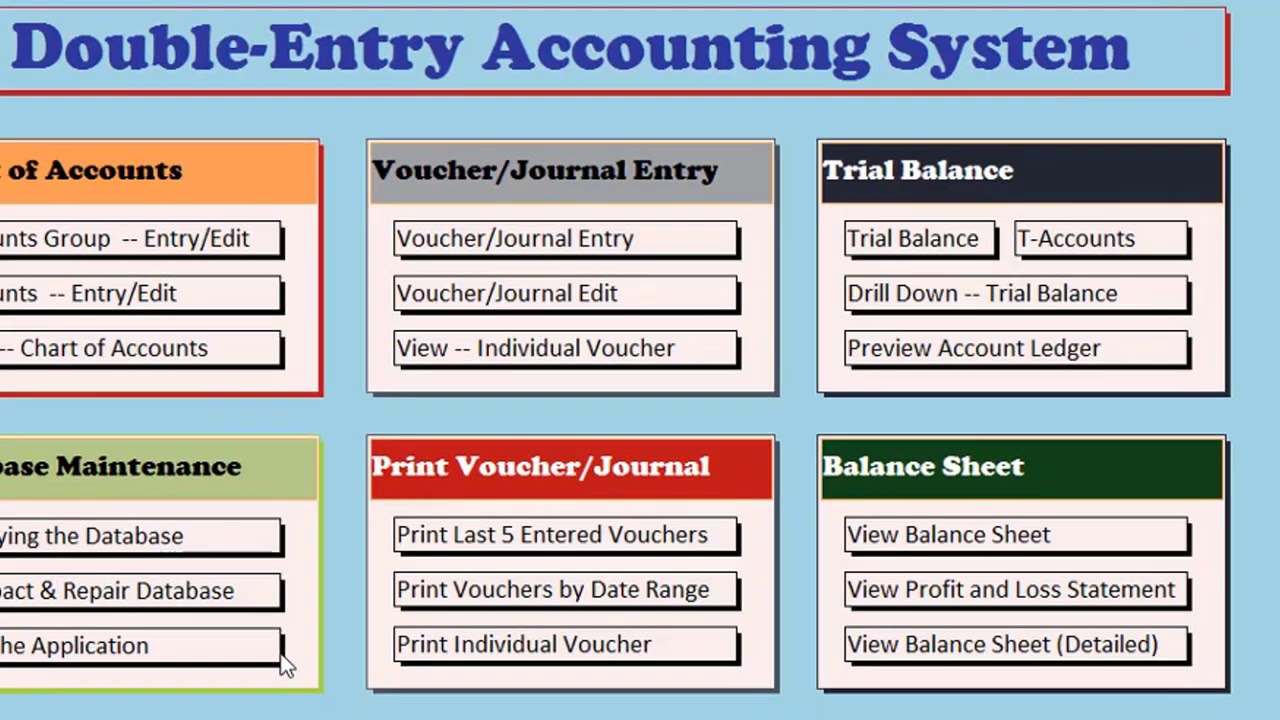

Double entry accounting template. Therefore, we must include all relevant details on the origin and destination of the money. Double entry accounting is the standardised method of recording every financial transaction in two different accounts within the general ledger. Create a chart of accounts for posting your financial transactions.

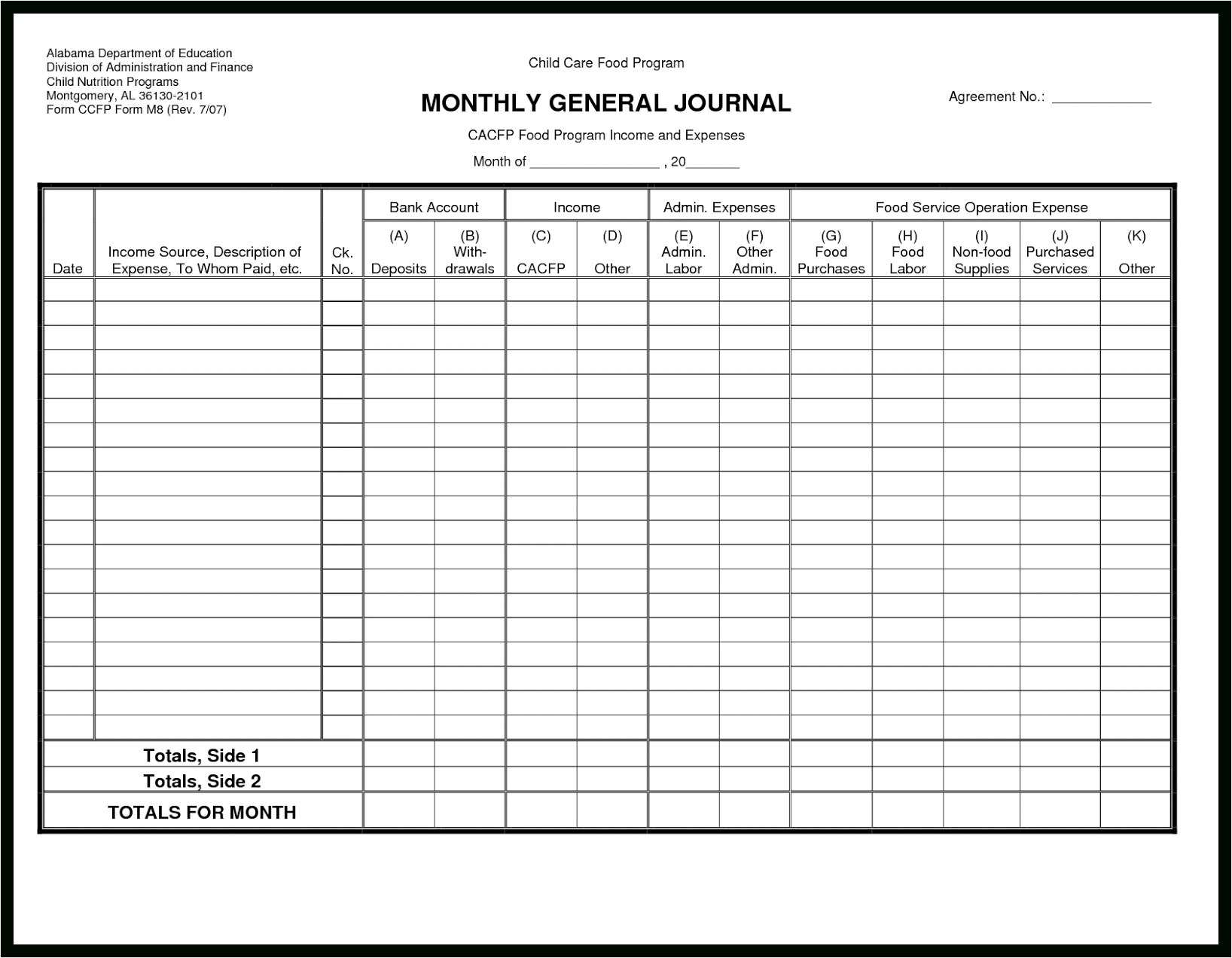

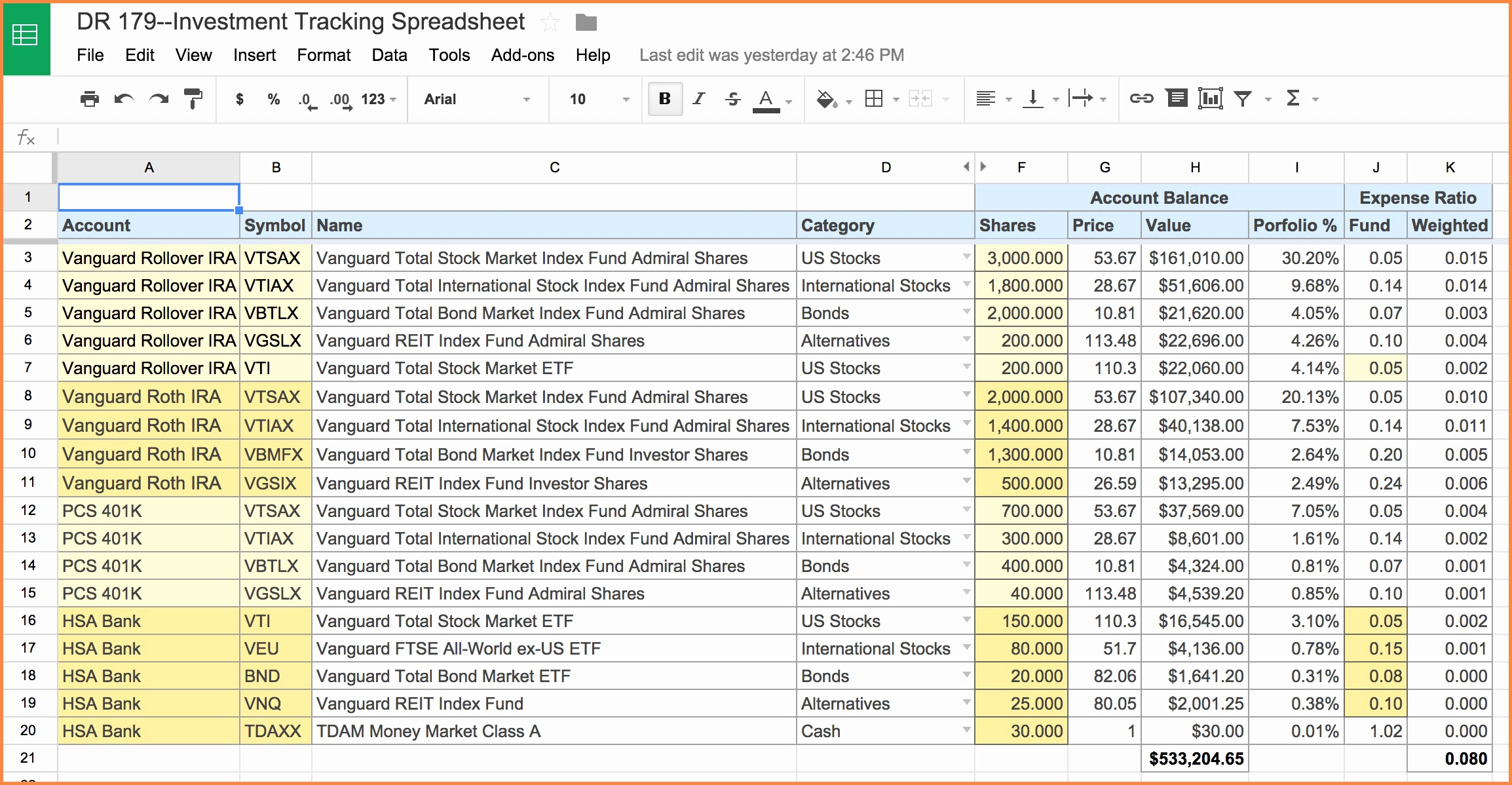

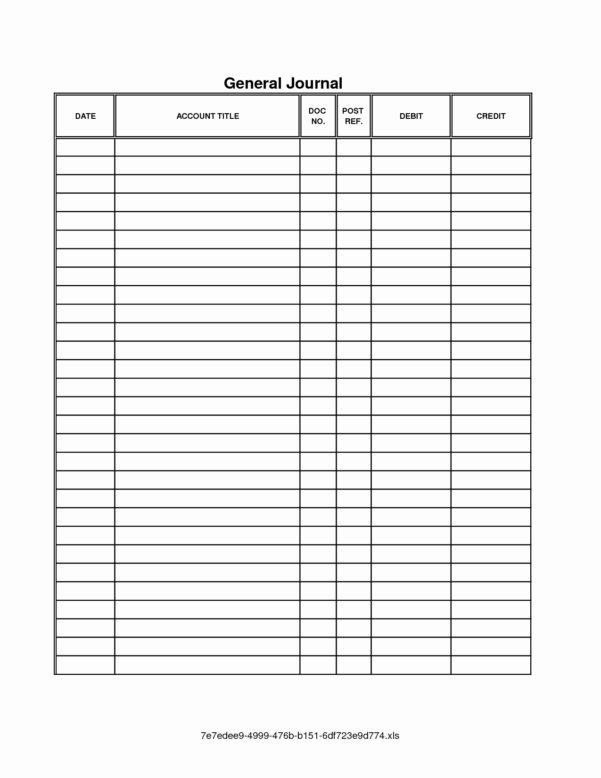

An accounting template will help you in the process of managing your business. The chart of accounts this lists all the accounts that make up your books. Blank general ledger printable sheet download the general ledger sheet is available for download in pdf format by following the link below.

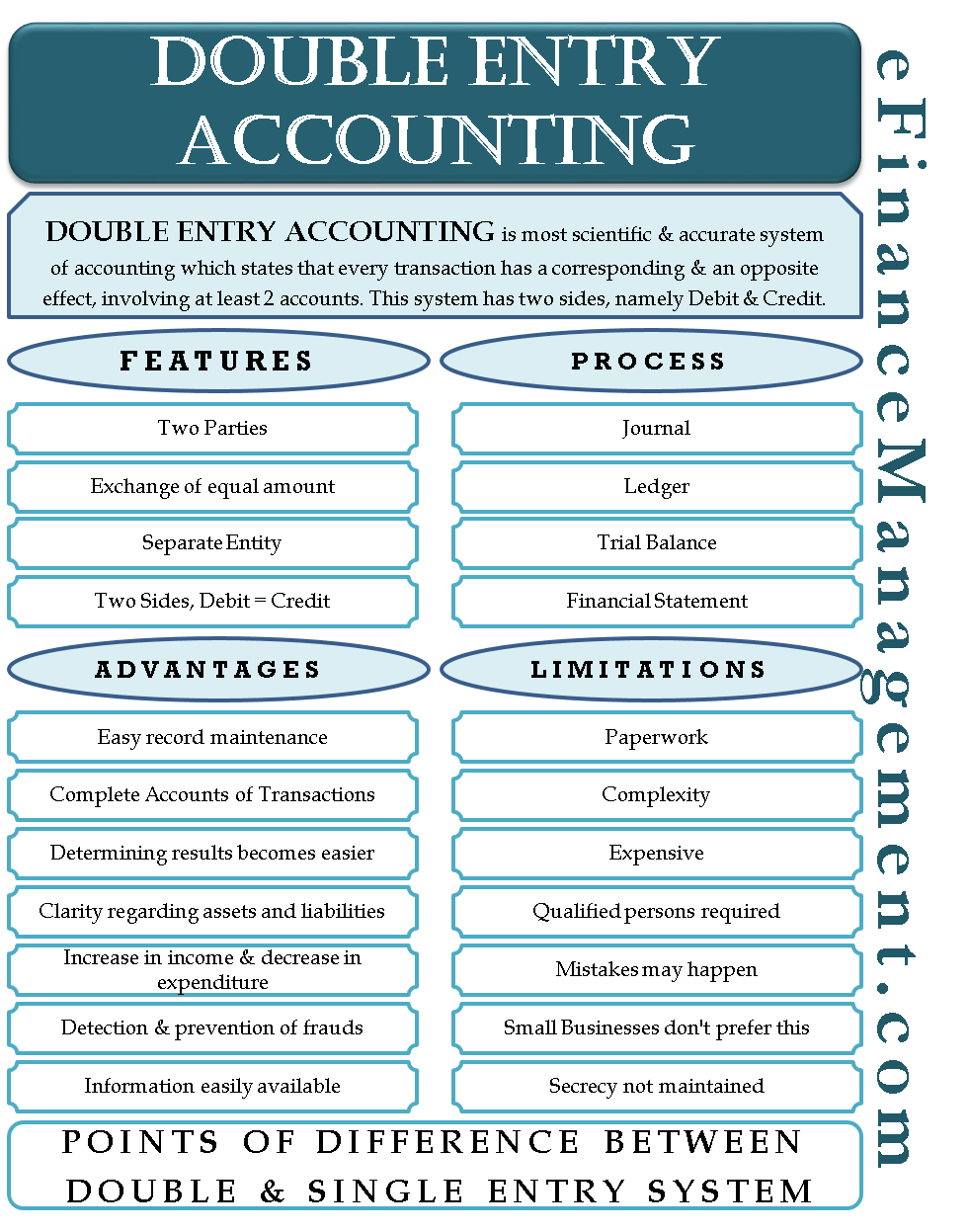

Every financial transaction gets two entries, a “debit” and a “credit” to describe whether money is being transferred to or from an account, respectively. Each accounting entry affects two. Last updated february 24, 2023 learn online now what is double entry bookkeeping?

The ledgers must have every transaction in a business with at least one debit entry and one credit entry. For each credit entered into a ledger there must also be a corresponding (and equal) debit. These free resources are available for you to download and use for your own personal development or business, and to teach or train others.

Every transaction you record gets sorted into one of these categories. Double entry is a bookkeeping and accounting method, which states that every financial transaction has equal and opposite effects in at least two. It’s based on the concept that every financial transaction has two sides:

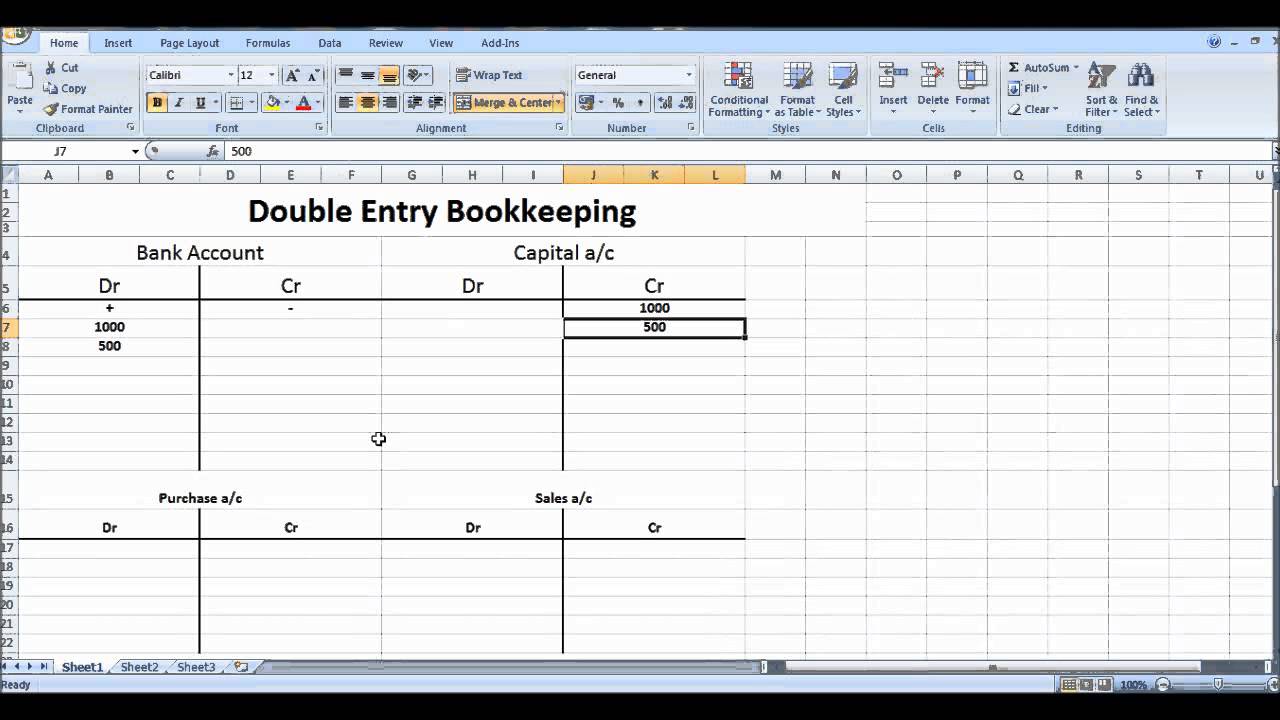

It is based on a dual aspect, i.e., debit and credit, and this principle requires that for every debit, there must be an equal and opposite credit in any transaction. Double entry bookkeeping is a standardized accounting system wherein each and every transaction results in adjustments to at least two offsetting accounts. For example, if a business takes out a $5,000 loan, the cash (asset) account is debited to $5,000 and the outstanding debt (liability) account is credited $5000.

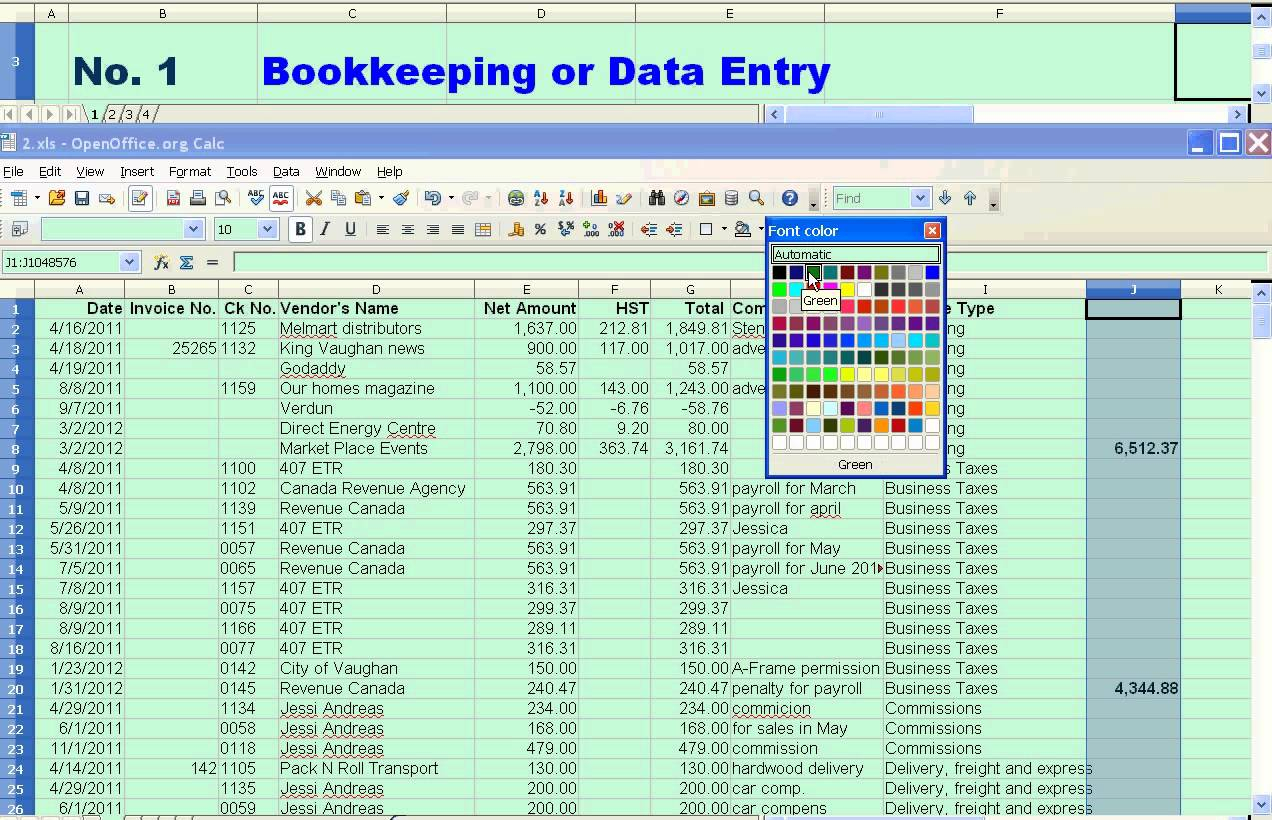

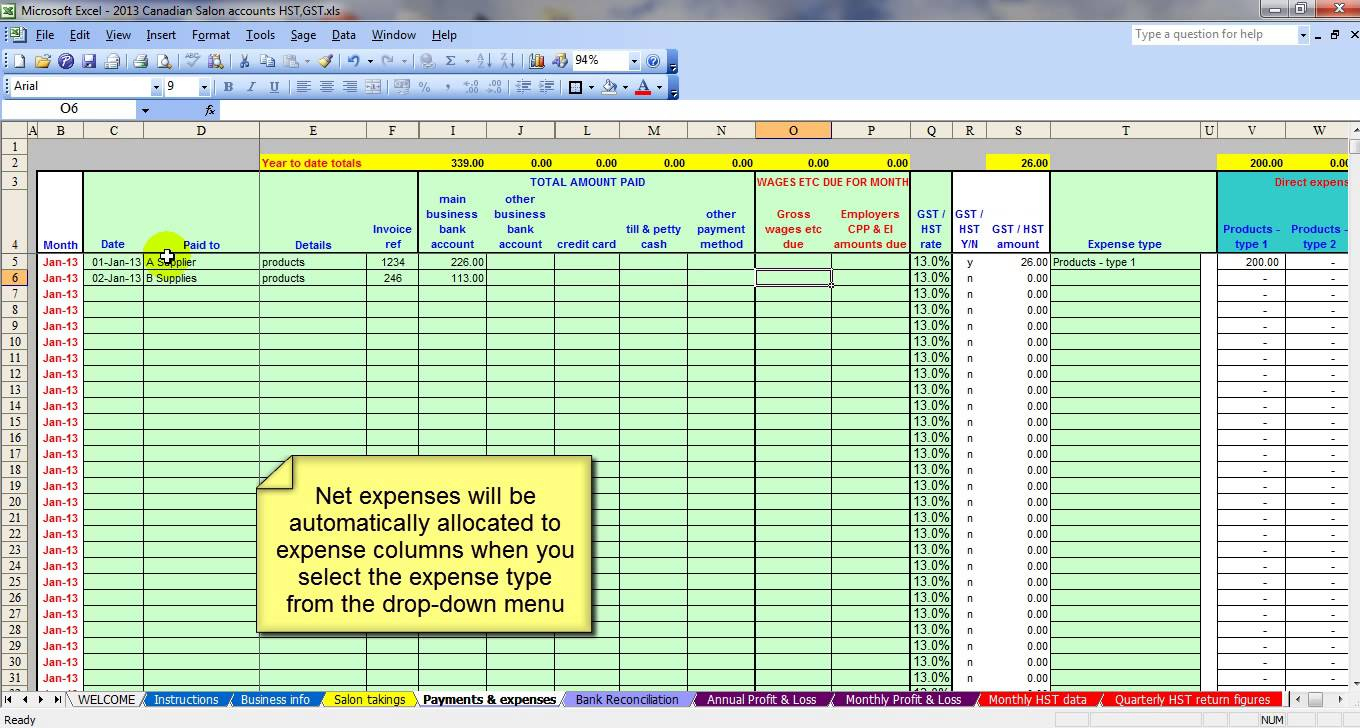

Gain unlimited access to more than 250 productivity templates, cfi's full. The formula for double entry accounting is: This page comes with 14 free accounting spreadsheets that have been downloaded 200985 times since 2006.

Overall, double entry accounting helps track finances and keeps a business’s books balanced, necessitating the involvement of a minimum of two accounts. Below are two double entry bookkeeping examples: This approach reduces the likelihood of accounting errors.

Accounts payable and receivable, journals and ledgers, simple and complex analysis, charts, statements, calculators, and. A debit to one account and a credit to another. This method of bookkeeping involves recording each financial transaction in at least two separate accounts, ensuring that the accounting equation, assets = liabilities + equity, is always satisfied.

For each credit entry within the general ledger there must also be a corresponding (and equal) debit entry. Ensure each entry has two components, a debit entry and. There are three sheets in bench’s income statement template: