Matchless Info About Cost Of Goods Sold Spreadsheet Template

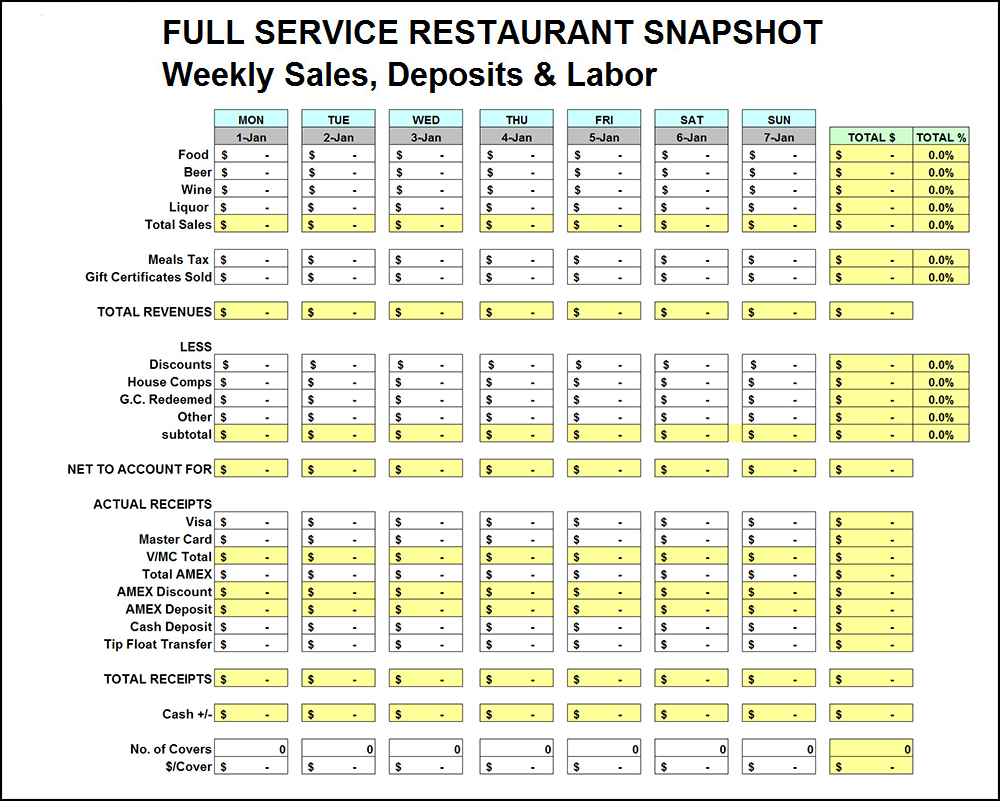

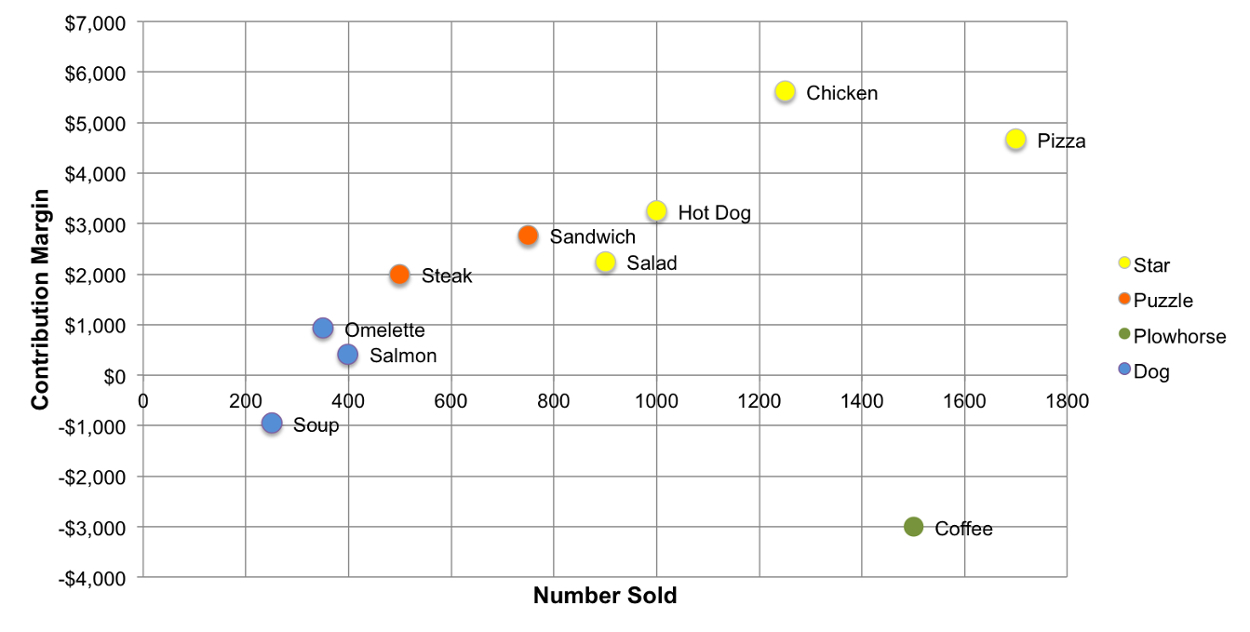

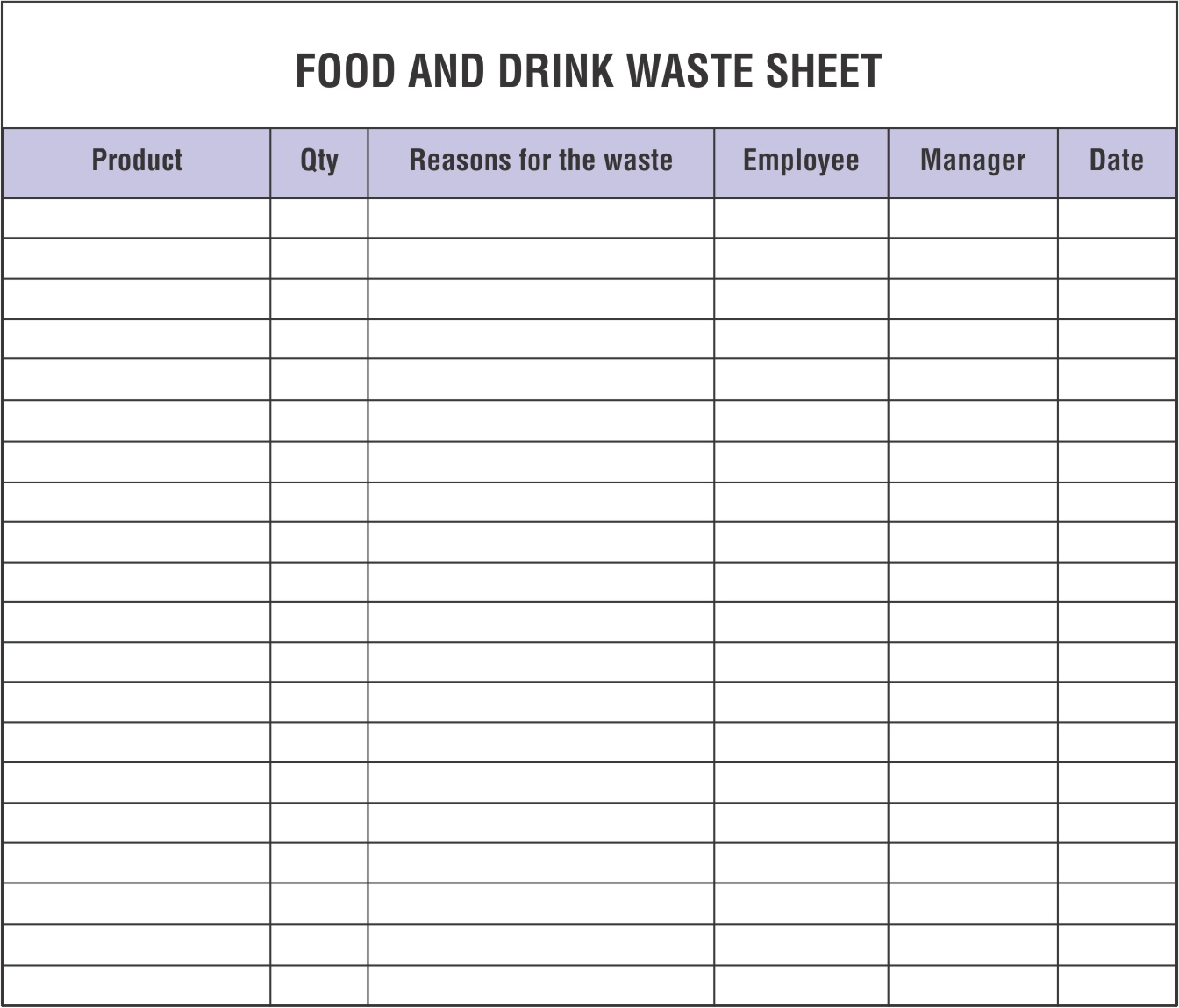

A company that sells a large variety of items will benefit from this type of worksheet.

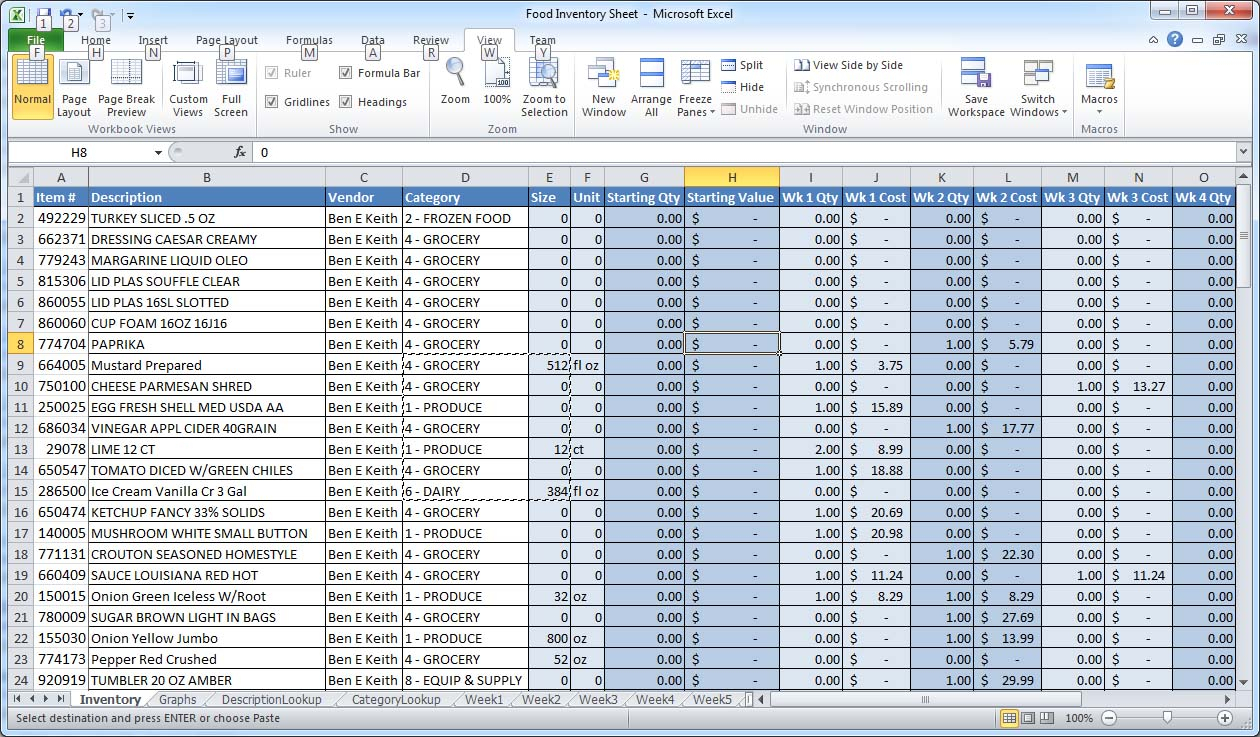

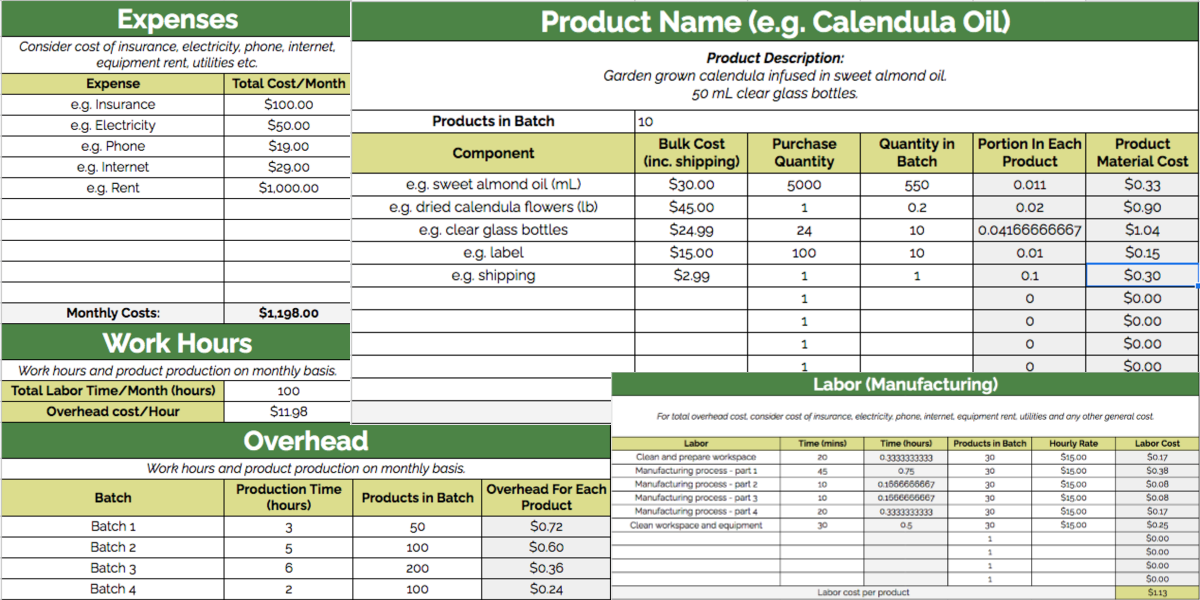

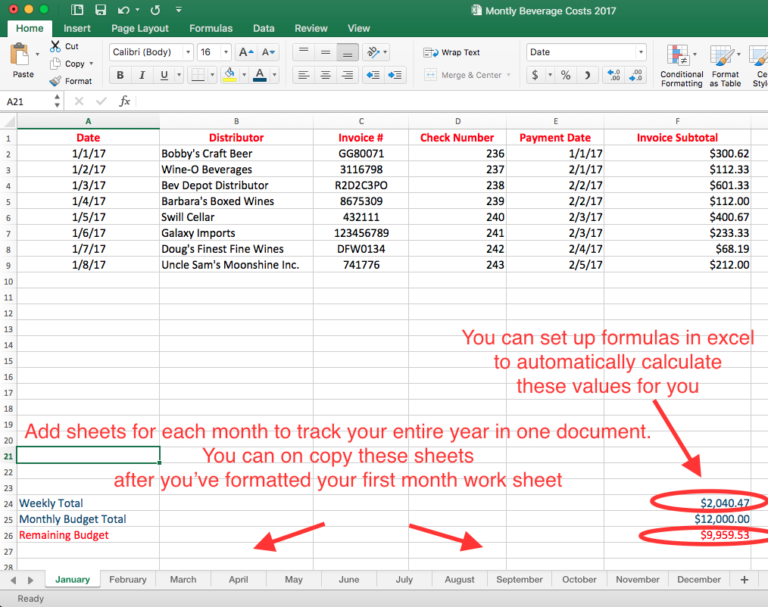

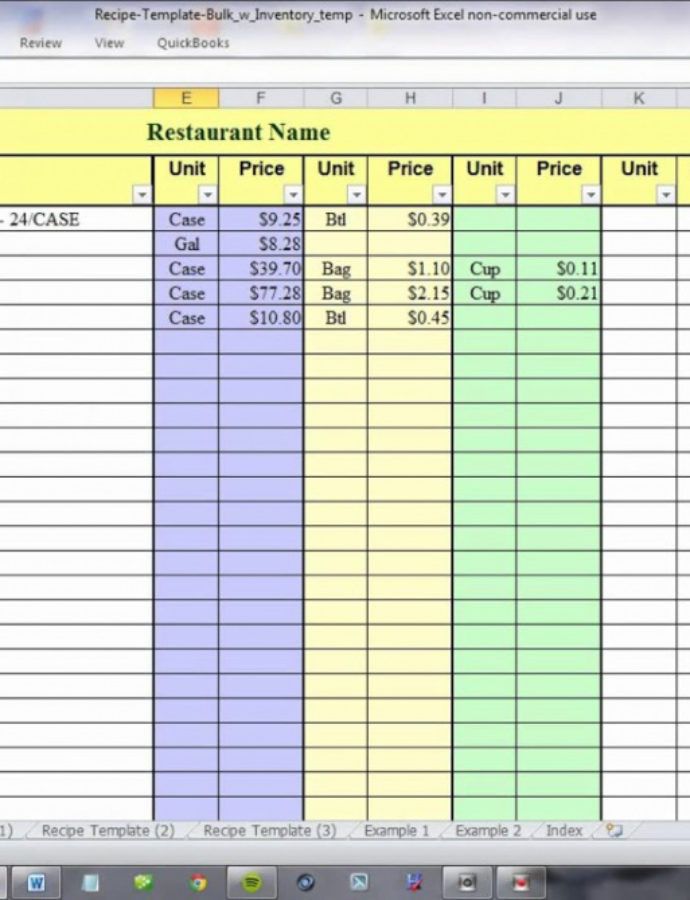

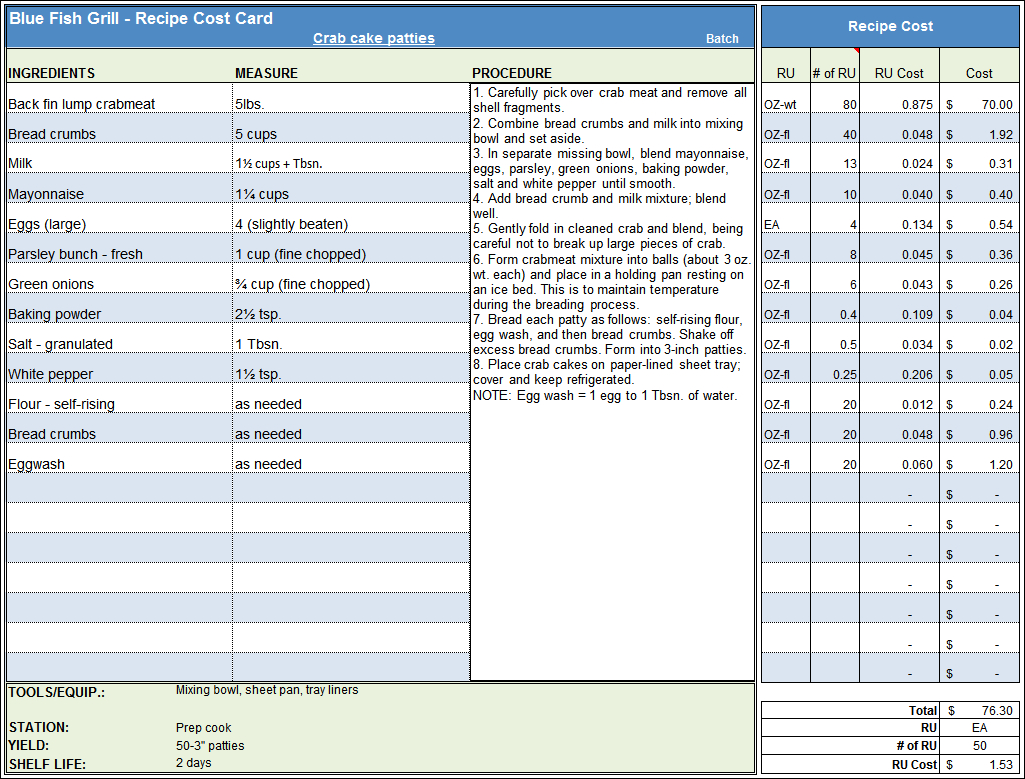

Cost of goods sold spreadsheet template. Cost of goods sold: To calculate cogs, the formula is as follows: This easy to use inventory and cost of goods sold spreadsheet template is designed to help you with the very basics of tracking your materials, products and orders to get you started on your inventory journey.

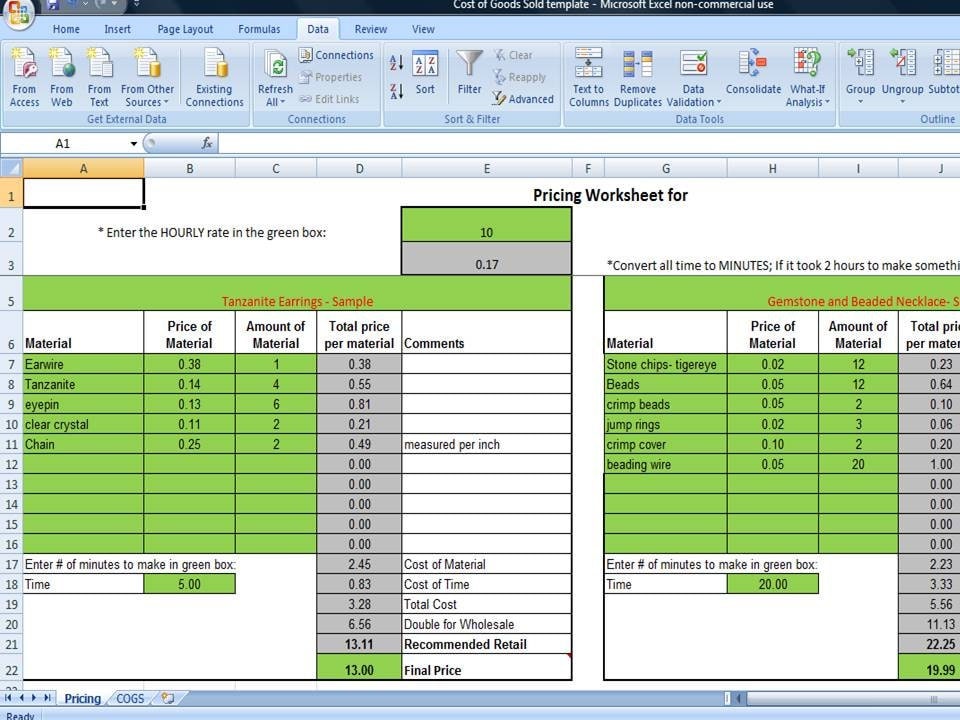

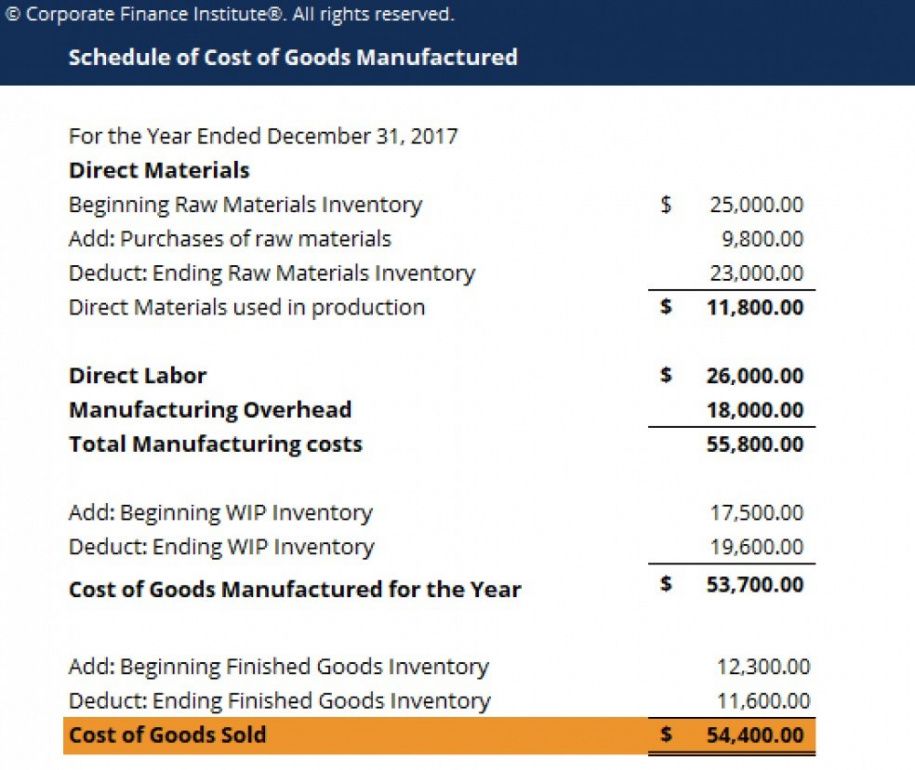

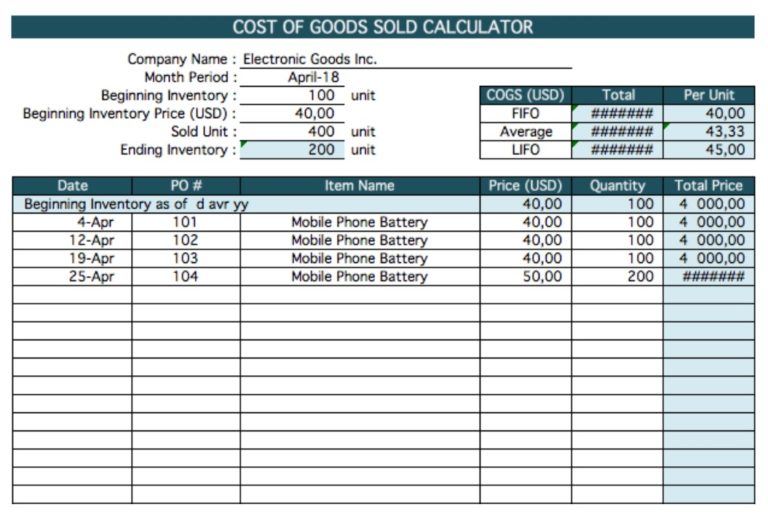

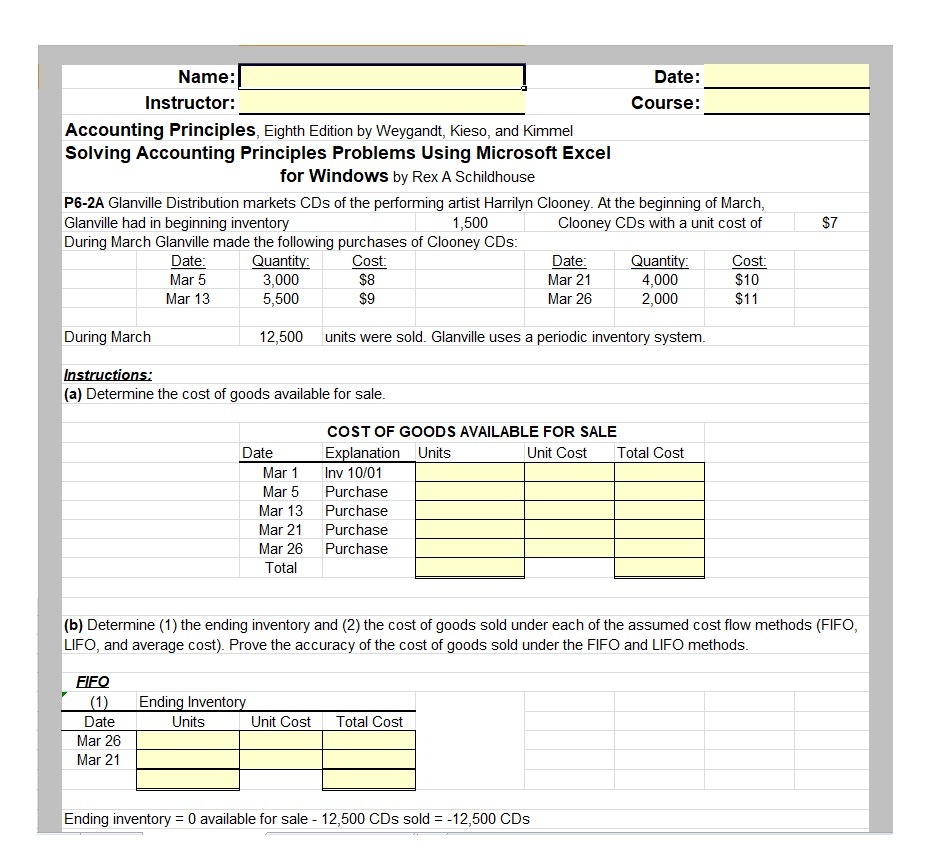

This cost of goods sold template demonstrates three methods of cogs accounting: A retail store that has numerous items of the same type but different styles and sizes will also benefit. How to calculate cost of goods sold:

This particular template is free, downloadable and ready to use right away. Beginning inventory refers to the value of your stock at the start of a financial. Following the schedule above, we can calculate the cost of the remaining apples and the cost of goods sold.

Review your gross profit (i.e., your gross revenue minus cogs) for accuracy. Download our free template today and save yourself the time of creating your own inventory spreadsheet from scratch! Cogs template you can download below is based on that merchandising companies model.

100 apples sold at $1.20/apple = $120 in cogs. Download cost of goods sold excel templates here sample cost of goods sold excel template download cost of goods sold excel calculation template download example cost of goods manufactured and sold template download first year’s cost of goods sold forecasting template download example cost of goods. Yes, the cost of goods sold (cogs) is an expense.

Enter your name and email in the form below and download the free template now! Let’s break down each component of the cogs equation further. Tracking cogs will help you:

Last in, first out (lifo), items purchased last are sold first. This excel spreadsheet lets you compare and analyze multiple products and services by enter monthly units sold, unit price and cost of goods sold (cogs). This template is divided into several sections:

100 apples sold at $1.45/apple = $145 in cogs. How do i calculate the cost of goods sold? First in, first out (fifo), items purchased first are sold first.

Download the free excel template. This figure includes materials and labor costs, but excludes indirect expenses, such as sales and distribution costs. You’ll also learn what to include in each component of an operating budget.

Fifo, lifo, and weighted average. Based on accounting rules and inventory valuation method, cogs can be calculated using one of three cost flows : View our free and editable cost of goods templates for excel or google sheets.